January 3, 2024

Erste Group Impacts Customers’ Financial Health With Personetics

At the recent 3rd Annual Digital Banking Congress in Berlin, I had the pleasure to present with Catarina Adegas Ferreira, Product Owner of George Labs. George Labs is the Digital Banking Platform of Erste Group, which operates banks in 7 CEE markets and serves over 9.3 million digital customers. Catarina explained why Erste chose to partner with Personetics to enhance their customers’ financial health through hyper-personalized insights and advice.

As Product Owner at George Labs, Catarina contributes to developing Erste Group’s digital mobile app. Her goal is to foster a mobile app experience that delivers on the bank’s commitment to provide excellent, personalized advice. Catarina’s task at George is to implement a digital solution to accelerate Erste Group’s strategic shift from providing financial services to enhancing customers’ financial health.

Erste’s Strategy Statement

“We want to become a lifelong companion for our customers when it comes to financial health. We want to be the advisors who take into account the customer’s entire life situation and then – based on the best data and knowledge, of course – offer them the best advice.”

Erste’s goal was to empower its users to make the right decisions, at the right time, based on each customer’s life situation and financial data. To be able to do so, they identified three key capabilities that were essential for the George app:

The 3 Key Capabilities Essential for the Success of the George App:

- Intelligence. The platform had to have the intelligence to analyze large quantities of financial data and identify user characteristics and behaviors.

- Proactive guidance. The bank did not want an app that would look at a customer’s balance at the end of the month and tell them, “You should have saved more.” They were looking for a solution that would help provide real-time information and suggestions that could help customers achieve their financial goals.

- Hyper-personalized advice. Every banking customer has a unique set of financial resources, challenges, goals and behaviors. If George suggestions did not take those into account, they could not be as valuable and effective as possible.

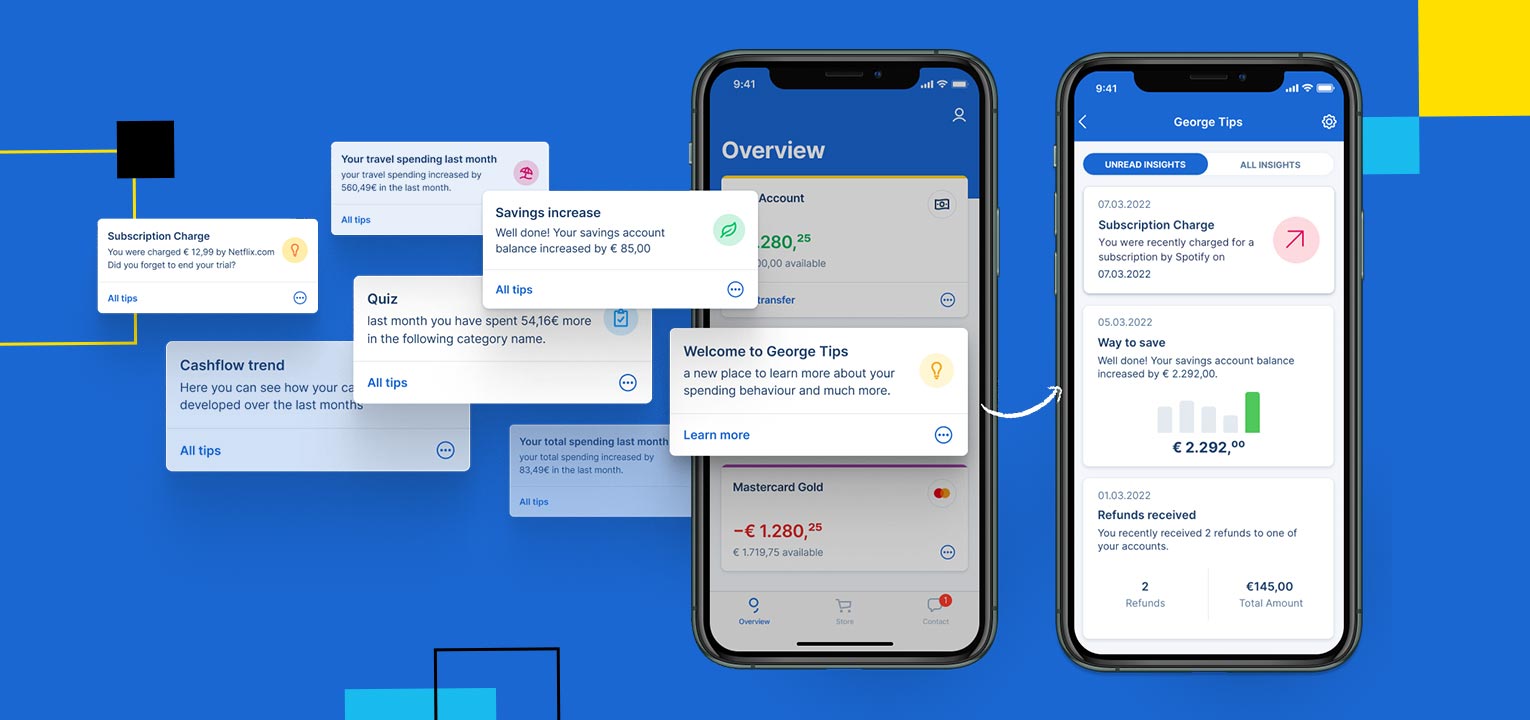

George Tips

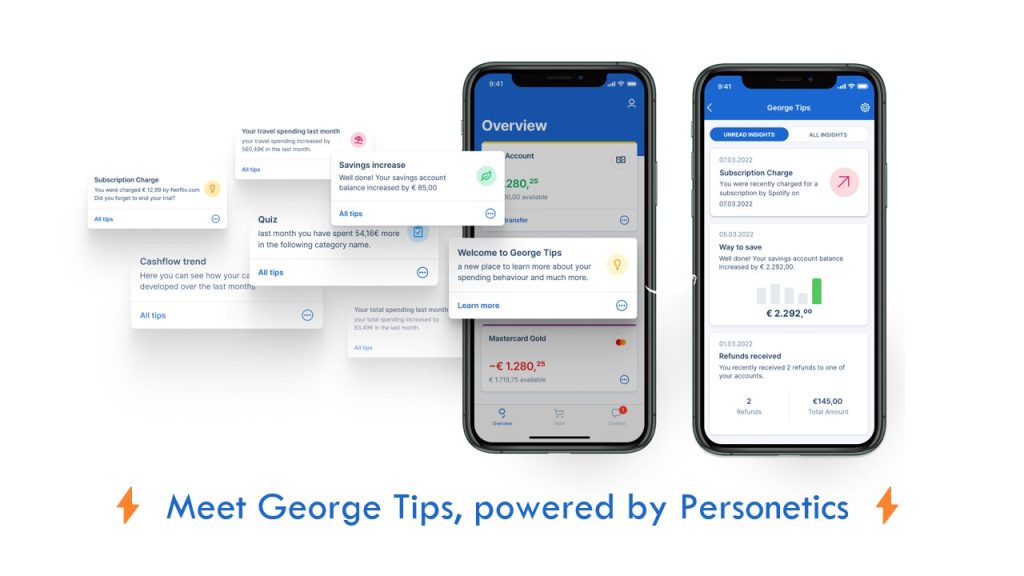

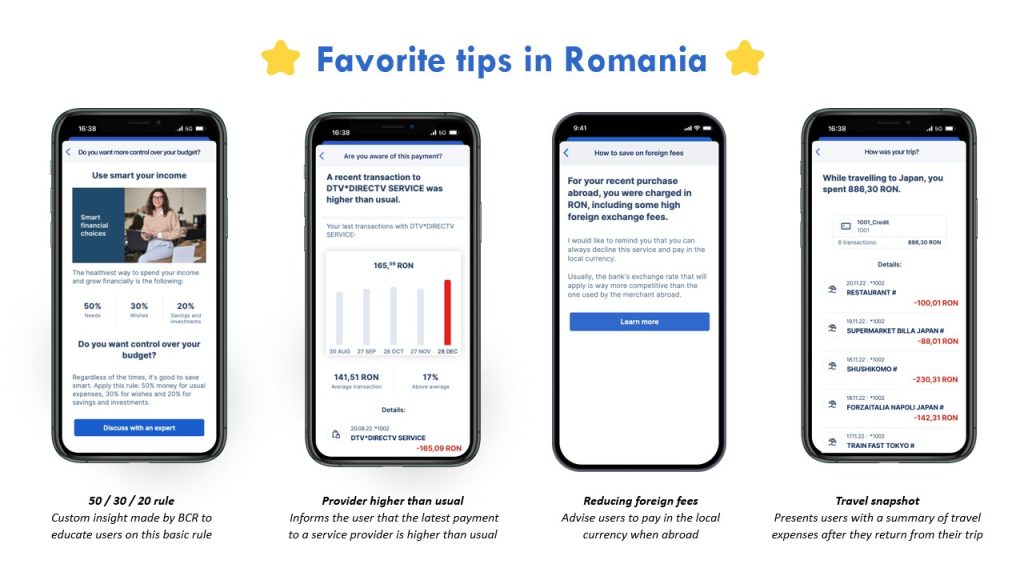

To convey the truly personal nature of their mobile app experience, Erste Bank named its Personetics-powered personalized insights “George Tips.” Over the past year, the bank has rolled out George Tips gradually, starting in Erste Bank Romania (aka: BCR) and is now extending it to Austria, the Czech Republic and Hungary. Seven months after the roll-out in Romania was completed, George Tips achieved outstanding results: click rates (Call-To-Action) of 50%, over 20% engagement rate, and an average of 4.5 out of 5 in satisfaction rate of Erste’s 2 million local customers.

George Tips are based on real-time AI-based analysis of each individual customer’s personal data and delivered on a timely basis. A typical George Tip may advise a customer about a savings plan that would work for them when their account balance exceeds an amount that constitutes a safe buffer, based on their seasonal monthly expenses. Another Tip might alert a customer that they have been charged twice for the same amount by the same merchant, a common sign of an erroneous charge. One of the most useful Tips alerts customers if one of their regular monthly expenses suddenly increases. This is especially valuable for expenses that are paid automatically, since consumers might not realize that the fee they are paying has suddenly increased.

George Tips figures from Romania, the initial market where Erste Bank rolled out the service, which Catarina presented at the Congress, tell a clear story of success:

The 5 Elements of Success for Erste Romania and Personetics: A Strategic Analysis:

- 4 million personalized insights are generated each month

- 4.5/5 average rating for insights, overall

- 20% engagement with overview tips

- 28% Conversion rate (CTA) with Personetics out-of-the-box insights and advice

- 50% Conversion rate (CTA) with Erste’s developed insights within the Personetics platform

Erste’s Blueprint for Success: Building Their Own Insights

While Personetics provides a host of valuable insights out-of-the-box, Catarina’s team chose to invest in Personetics’s Engagement Builder so they could also develop their own insights for customers. Personetics’ Engagement Builder is a codeless creation and management console. Because the Engagement Builder is an intuitive, “no code” platform, the George Tips team can create new insights in a matter of minutes.

The Strategic Roadmap of Erste and Personetics Collaboration

With the George Tips outperforming expectations in Romania, Erste is embarking on an ambitious expansion of the service to the many countries that it serves. Roll-out has begun in Austria and pilot testing is underway in the Czech Republic. In Hungary, data preparation has been proceeding quickly and pilot testing will begin soon. In her presentation, Catarina stresses how George Labs’s great relationship with the Personetics team, and the team’s responsiveness to their needs, has enabled them to rapidly and easily adapt George Tips for each of the countries in which they operate.

Next Steps for Erste

George Labs is well on their way to full Personetics implementation. Next steps include:

- Completing George Tips rollout to all seven countries in which Erste operates.

- Expanding the library of tips by leveraging Engagement Builder to fine-tune existing insights and create new insights based on customer feedback and preferences

- Explore additional functionality such as push notifications, web implementation, and a subscription dashboard

With Personetics insights integrated in George Tips, Erste Group is able to successfully provide valuable, productive advice to their digital customers in a way. By focusing on meaningfully contributing to customers’ financial health, Personetics helps Erste build strong relationships and deliver on the banking group’s commitment to having a positive impact on customers’ lives.

Contact us today to discuss how your bank can increase engagement and customer satisfaction by providing meaningful, actionable financial insights and guidance via your app.

Want to explore how your bank can harness the power of AI to engage and serve customers? Request a demo now

Latest Posts

Why Asia Pacific Pacific Banks Must Lean into Cognitive Banking: A Conversation with Dr. Dennis Khoo

Explore our Spring Release Highlights – From Integrated Marketing Offers, to Custom Trackers, and AI Innovation

Showing the Human Side of Digital Banking: Insights from Desjardins' Nathalie Larue

Kilian Riedl

DACH Head of Sales

Kilian has been focused on transforming mobile-first user experiences across diverse industries for more than 25 years. Having worked in both startups and corporate companies including roles at Amdocs and Salesforce, he has held several positions starting from product and project management to solutioning and sales, and account management. Throughout his career, Kilian’s focus has always been on creating value from improving mobile and omnichannel capabilities. Spanning from mobile portals over CRM software to AI based personalization and engagement solutions, he has helped companies in comms, media, logistics and the banking industry to adopt a more customer-centric approach.