Executive Summary

Executive Summary

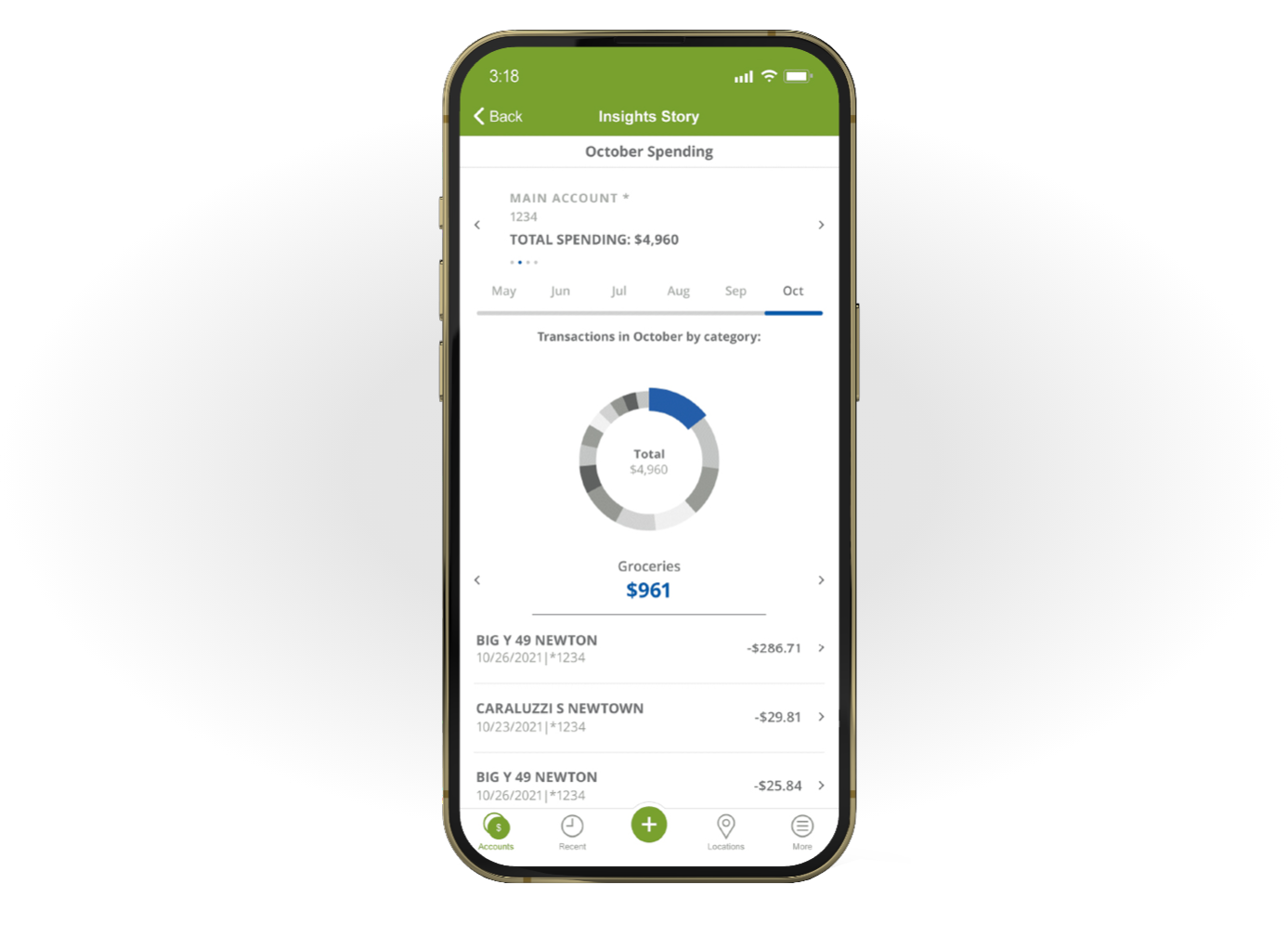

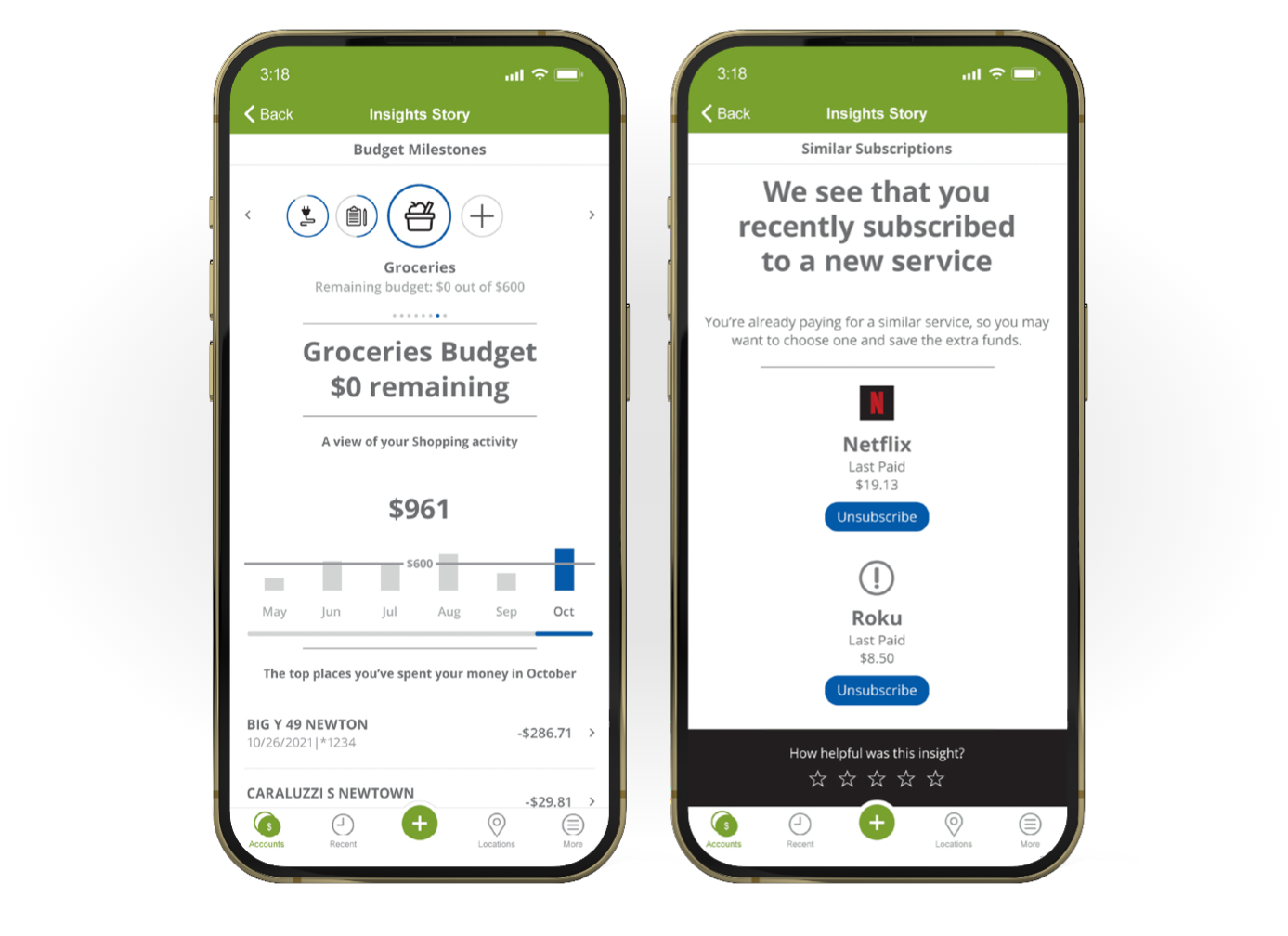

Community banks are competing against agile, digital-first fintech apps and major banks with big budgets for digital features. Today, with the help of partners like FIS and Personetics, community banks are actively deploying new personalized financial wellness strategies that are driving differentiation, digital engagement, and building trust and loyalty with customers. These partnerships are enabling community banks to respond quickly, and effectively compete with these emerging fintechs and capabilities.