February 22, 2024

Saving Money Becoming a Priority for UK Banking Customers

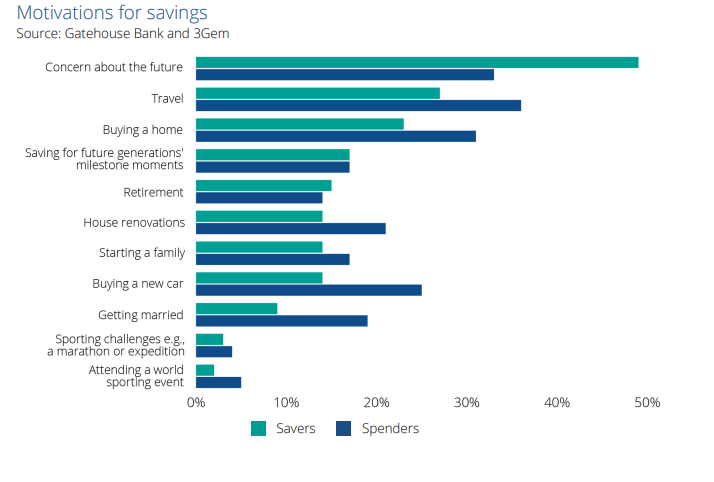

A recent study published by Gatehouse Bank reveals that one in three adults in the UK are focused on growing their savings accounts. The need to be prepared in this uncertain economic climate and higher interest rates has caused a shift in the mindset of UK banking customers. Here’s how an AI-based platform like Personetics ACT can successfully help customers build up savings and achieve their financial goals.

Personetics Automates the Savings Process

Personetics specialises in financial data-driven personalised engagement. The company’s automated savings platform called ACT analyses each customer’s financial data (typical deposits, accumulated savings, loans, monthly bills, etc.) and offers insights and suggestions to the customer on how to capitalise on savings opportunities. Personetics’ solution leverages artificial intelligence and customers’ historical financial behaviour and data to empower customers to save and invest more effectively. By identifying an individual’s recurring income and repeating expenses each month, ACT helps customers put aside a percentage of their money into savings using an AI-based risk strategy. Here’s how Personetics ACT can address the UK’s savings trend:

- Personalised Financial Guidance: ACT supports customers at every step with personalised guidance and advice based on their financial activity.

- Automated Savings Plans: The ACT solution introduces a user-friendly savings experience that takes the burden off the customer while tracking the individual’s progress on multiple savings goals.

- Intelligent Saving Decisions: ACT reduces impulsive spending or procrastination when it comes to paying bills or renewing subscriptions by considering past financial activity and preferences.

The Impact of an Automated Savings Programme on the Individual and the Bank

An AI-based automated savings programme utilising personalised data empowers individuals to take control of their financial future and addresses the UK savings trend head-on. In addition to creating happy and better-educated customers, the bank will see a dramatic growth in saving deposits. Here are some of the positive outcomes we can expect from previous applications of Personetics ACT:

- Improved Financial Literacy: Through AI analysis of data, the bank becomes a source of financial education and insights that can help users become more independent, ultimately making better decisions about their money.

- Increased Financial Resilience: As more people embrace automated savings, they will be better prepared to weather financial storms and unexpected expenses.

- Ability to Attract and Retain New Customer Segments: Banks can customize the outreach to introduce savings programmes to novice investors, young adults, and minors.

- Increased Deposit Growth: More customers focused on savings goals enhances the bank’s financial capital. BMO in Canada reported an increase of $50-100 million in deposit balances within one year of employing the ACT solution.

Conclusion

The change in banking customers’ mindsets to build savings presents an opportunity for local and national banks to better serve their customers and increase overall deposit growth. Introducing an intuitive AI-based savings programme that provides personalised, automated, and insightful advice will encourage customers to put aside more money. As this technology becomes more widely adopted, we can anticipate a future where financial wellness is within reach for more people, ultimately leading to happier customers who are financially secure.

To discover how Personetics can enhance your savings strategy, please explore our Act solution or contact Personetics for a free consultancy session

Nick will also be attending the upcoming MoneyLive event, so you are welcome to contact him to book a face-to-face meeting and learn how you too can benefit from his vast experience in leading transformation for Europe’s leading banks.

Want to explore how your bank can harness the power of AI to engage and serve customers? Request a demo now

Latest Posts

Why Asia Pacific Pacific Banks Must Lean into Cognitive Banking: A Conversation with Dr. Dennis Khoo

Explore our Spring Release Highlights – From Integrated Marketing Offers, to Custom Trackers, and AI Innovation

Showing the Human Side of Digital Banking: Insights from Desjardins' Nathalie Larue

Nick Platjouw

Regional Sales Director

With over 10 years of experience in the Fintech industry Nick has been involved in some of the largest digital transformations in the banking industry. Recognized for expertise in digital banking and a proven track record in driving innovation within the fintech landscape.

Nick is passionate about driving innovation in the digital banking sector. That was one of the main reasons that Nick joined Personetics, as he believes that data-driven personalization and AI will be the next wave of disruption for the financial industry.

Nick holds a master’s degree in economics from Nijenrode Business University.