November 30, 2021

Why Banks and B2C Companies are Embracing Carbon Footprinting

Climate Change is top of mind for consumers worldwide, as world leaders have gathered in Glasgow for the COP26 climate summit. Banks are seeing strong, growing demand for green banking products as part of their overall Corporate Social Responsibility (CSR) efforts.

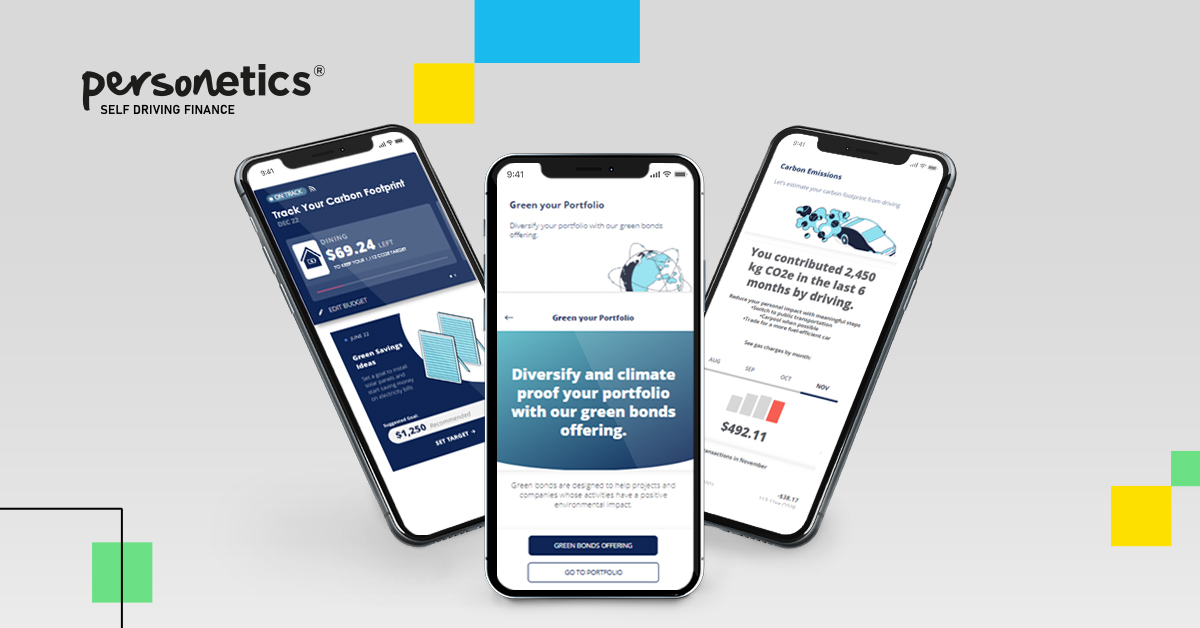

Personetics has recently launched the availability of Carbon Footprint Tracking data analytics tools, as part of our Personetics Engage offering. Along with Personetics, there is a larger trend of financial institutions empowering consumers to be more climate-friendly with their everyday purchases and investment decisions.

Carbon Footprinting for Consumers: Examples

There are a few recent examples of financial institutions and other consumer-facing companies offering carbon footprinting solutions:

- Bank of the West offers a 1% for the Planet checking account which includes a carbon tracking tool to show the carbon impact of the customer’s debit purchases.

- Challenger bank Aspiration offers a Zero carbon credit card which calculates the carbon impact of each transaction, automatically plants carbon-offset trees, and provides up to 1% cashback on qualifying environmentally-friendly purchases.

- Consumer Packaged Goods giant Unilever is planning to measure the carbon footprint of 30,000 of its 75,000 products in the next six months and will test carbon footprint labeling on up to two dozen of its products in North America or Europe by the end of 2021.

- Google is now displaying flight-specific, seat-specific carbon emissions estimates for most flights on Google Flights, and the company’s Google Maps app has launched a new feature to display the most eco-friendly routes for drivers, marked with a green leaf icon. When looking for directions in the app, users can get more details about how choosing a different route can help them reduce fuel consumption.

- A 2020 Carbon Trust survey found that 67% of international consumers support carbon labeling, and 64% say they would think more positively about brands that can show a reduction in their products’ carbon footprints.

Why Banks Need to Embrace Carbon Footprinting

Consumers are raising their expectations for what they want to see from banks and other companies on Environmental Responsibility. By offering carbon footprinting tools, banks can demonstrate that they’re aligned with their customers’ personal priorities, and help build customer loyalty.

ESG products and green banking solutions also tend to be popular with mass affluent customers and can be a point of entry to attract these customers for higher-value banking relationships, investment products, advisory services, and more.

Be a Trusted Advisor on Clean Spending

We are in a critical moment where customers are looking for companies who understand their values and priorities, and who show leadership with visible actions on CSR and climate change. Banks have a big opportunity to deploy carbon footprint tracking as a way to build trust with customers, to show customers that they can help manage their financial lives in a way that aligns with the customer’s personal values. Showing a customer their personal carbon footprint, offering relevant insights and advice, and recommending ESG products at the right time can be part of deepening their banking relationship and being the customer’s trusted advisor.

Is your organization ready to learn more about Carbon Footprint Tracking and how to drive green banking innovation for your customers? Talk to Personetics today.

Want to explore how your bank can harness the power of AI to engage and serve customers? Request a demo now

Latest Posts

Why Asia Pacific Pacific Banks Must Lean into Cognitive Banking: A Conversation with Dr. Dennis Khoo

Explore our Spring Release Highlights – From Integrated Marketing Offers, to Custom Trackers, and AI Innovation

Showing the Human Side of Digital Banking: Insights from Desjardins' Nathalie Larue

Nicole Meyers

VP Strategic Account Management

Nicole brings over a decade of experience in consumer banking strategy and operations. In her role, Nicole is responsible for building and growing client relationships, ensuring each project achieves impact. Prior to joining Personetics, Nicole was a consultant at McKinsey & Company, where she advised financial services clients on digital enablement, regulatory compliance and strategic planning. Nicole led the World Economic Forum’s initiative to promote global financial inclusion, in partnership with the World Bank Group. Nicole also served as the Director of Strategic Partnerships at Grameen America, a micro-lending credit union, where she built and managed savings programs with Wells Fargo, Citibank and Capital One. Nicole holds a B.A. in International Relations from Bucknell University.