Green Banking withouout Greenwashing: how Sustainability can buils Trust with Banking Customers

Carbon Footprint Tracking: How it Helps Your Customers

Personetics carbon insights help your bank reinforce your CSR commitments by:

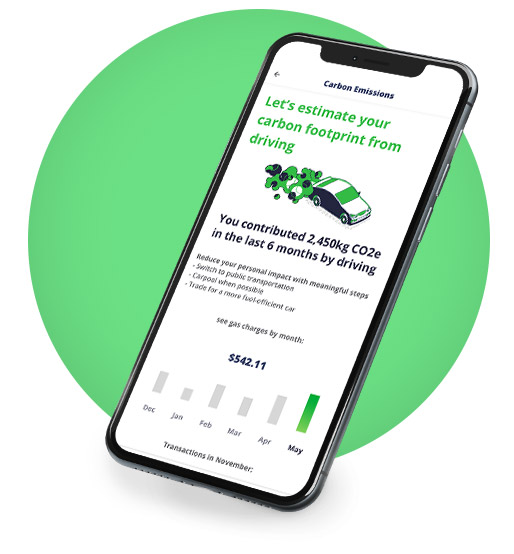

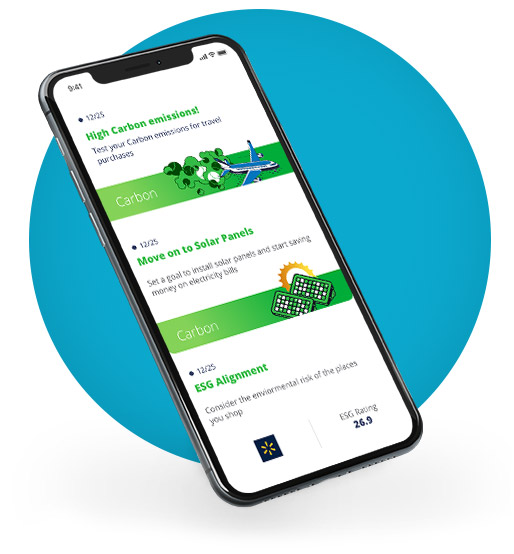

Empowering your customers to monitor and reduce their personal carbon footprint.

For many customers, this might be the first time that they can see an accurate calculation for their personal carbon footprint, as well as learn how to make more climate-friendly changes in their everyday consumer choices.

Encourage nonprofit donations to customers based on relevant transaction history.

If your customers have a history of charitable giving to environmental organizations, Personetics can help you create data-backed insights to suggest additional donations.

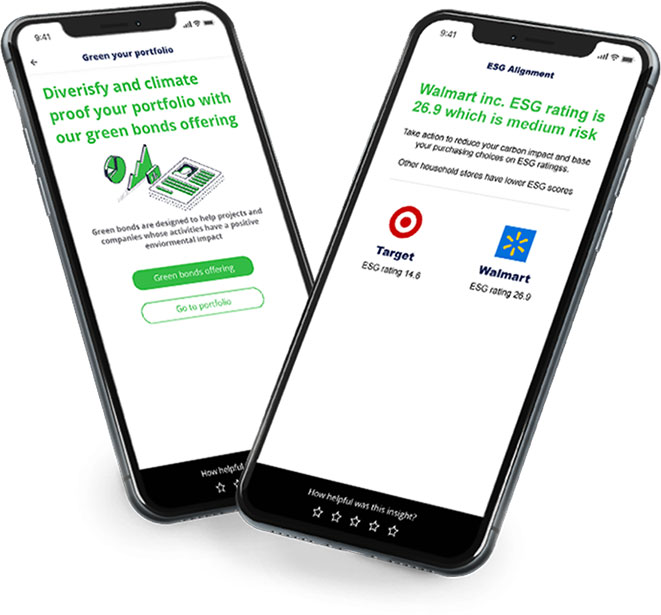

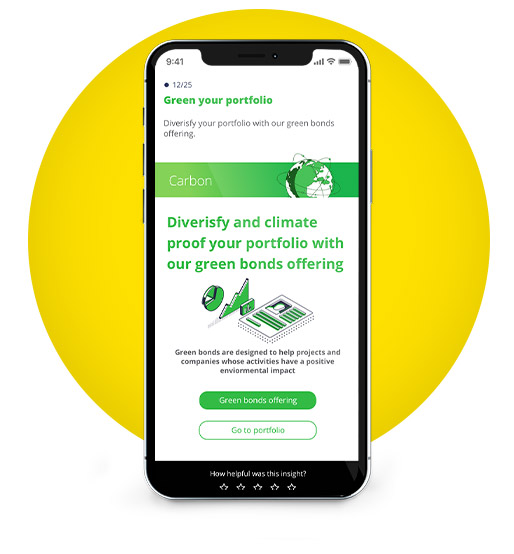

Suggesting ESG products and actions to environmentally conscious customers.

Personetics can help your financial institution recommend specific actions to your customers, such as how to buy a lower-carbon product, how to reduce their consumption of energy, invest in an ESG index fund, lower their spending on certain carbon-intensive categories, or save up to buy solar panels for their home.

Addressing young people’s concerns on climate change.

A recent global survey found that nearly 60% of young people are very worried or extremely worried about climate change. Carbon emissions insights can help banks reinforce their commitment to CSR and green banking, while getting creative with relevant value propositions for a younger consumer audience.

Carbon Footprint Labeling: Why Now?

Consumers are raising their expectations for what they want to see from banks and other brands on Environmental Responsibility. A 2020 international consumer survey from The Carbon Trust found that 67% of consumers support carbon labeling, and 64% are more likely to think positively about a brand that can show that it has reduced the carbon footprint of its products.

Giving consumers better information about the carbon impact of their purchases can help people make better-informed choices and potentially contribute to broader momentum on addressing climate change.

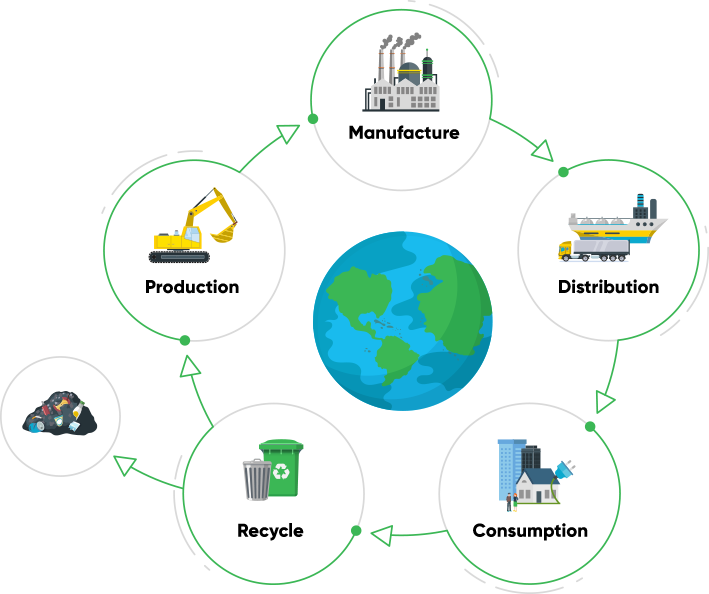

Personetics Carbon Footprint Tracking: How it works?

Our carbon insights solution analyzes public data to calculate the carbon footprint of each consumer transaction.

We take a lifecycle approach to measure total greenhouse emissions that are built into each transaction, including fine-tuned nuances of different prices and impacts at the national, regional and local level.

Learn More“Carbon footprint tracking is a big opportunity for banks to play a bigger role in helping their customers manage their financial lives in a way that aligns with their values and goals.”

Empower consumers to make greener choices

Reduce their carbon emissions with transaction-based carbon insights

Contact us