January 29, 2025

How Desjardins Empowers its Members with Personetics AI and Microsoft Azure

Author: Dorel Blitz, VP Strategy & Business Development, Personetics

Any savvy digital bank or credit union executive will be keenly aware that in today’s digital-first world, basic personal financial management (PFM) tools simply don’t make the cut when aiming to boost sales conversion rates.

And so, when Desjardins—the sixth largest financial institution in Canada and the largest federation of credit unions in North America—saw that more than 50% of their members had gone digital, they quickly adapted their mindset. As Etienne Chabot, Digital Transformation Manager at Desjardins, put so eloquently, “Our members are increasingly online, especially on mobile. We wanted to provide personalized financial management capabilities exactly when and where our members needed them, not through monthly statements requiring manual consolidation”.

In other words, if Desjardins wanted to boost their sales conversions and customer lifetime value, they first had to improve their engagement rates by empowering customers to make better financial decisions. For Desjardins, moving up to advanced PFM was no longer a ‘nice to have’ but a ‘got to have’.

With no time to waste, Desjardins also needed to deploy quickly.

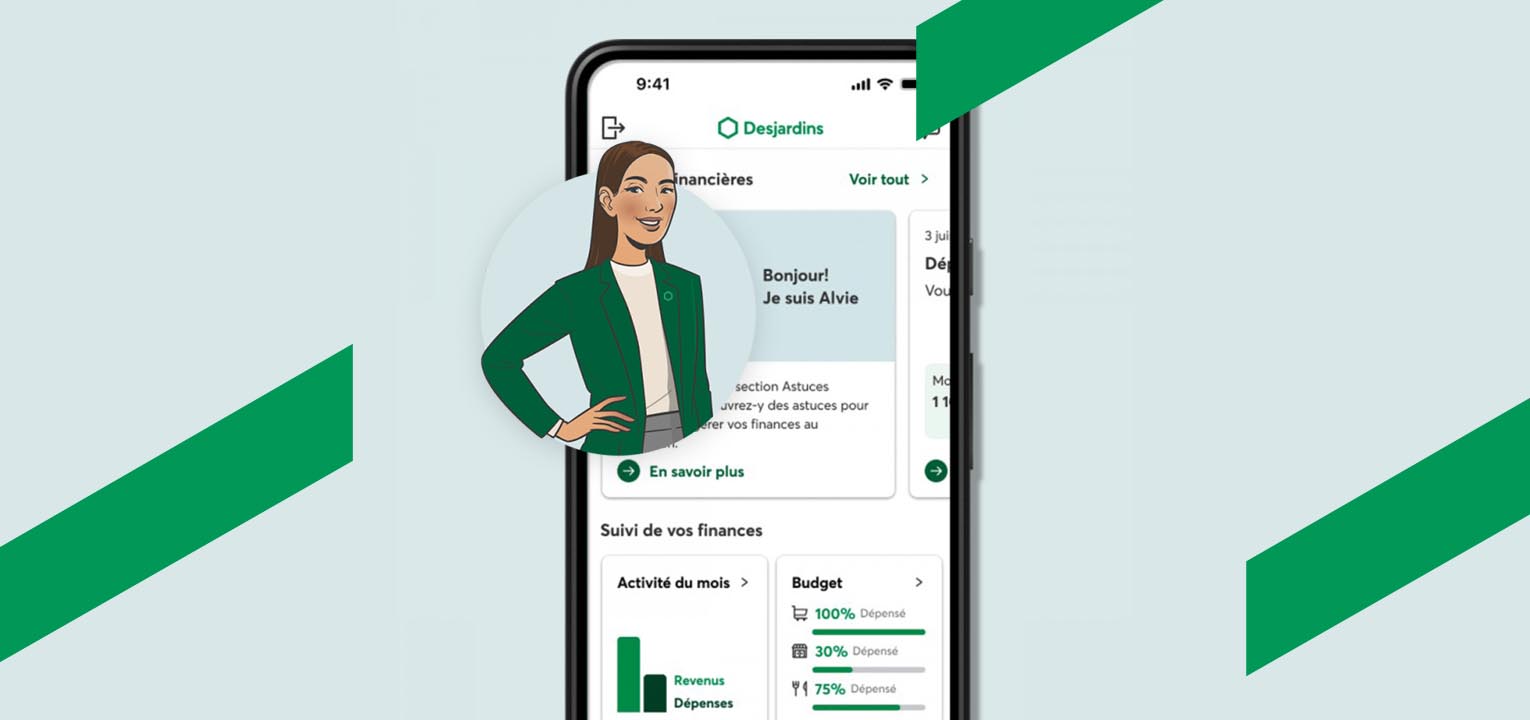

Within just four and half months of contract signing, Alvie, Desjardins’ AI-powered virtual assistant, was launched and has already seen outstanding measurable results (read on for more details).

Linkedin post from Nathalie Larue, Senior Vice President, Personal Banking Services, Desjardins

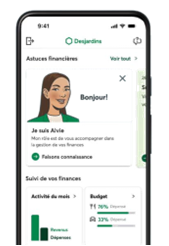

Meet Alvie – Desjardins’ New AI-powered Virtual Assistant

Launched in September 2024, Alvie represents the evolution from “Tell Me” to “Help Me” in digital banking by providing:

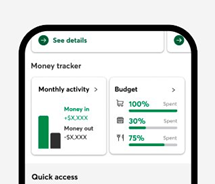

- Intelligent Tracking: Comprehensive financial trackers monitoring money in/out and budgeting.

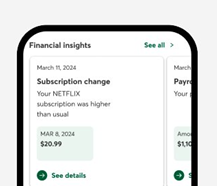

- Personalized Insights: Different types of actionable insights covering spending patterns, upcoming payments, and financial opportunities.

- Proactive Assistance: Multiple use cases helping members stay ahead of their finances.

- Smart Budgeting: Automated tools that make financial management simple and friendly.

- Agility: A codeless creation and management console (Personetics’ Engagement Builder) that allowed Desjardins to quickly create, modify, and upload customized insights in minutes.

Why Desjardins chose Personetics SaaS on Microsoft Azure?

When looking for an advanced PFM solution, Desjardins turned to their long-term technology partner, Microsoft, for a vendor recommendation. They wanted an end-to-end platform that is both future-proof in terms of scalability, agility and innovation, and also focused on delivering measurable business outcomes.

For Desjardins and Microsoft, the decision to go with the Personetics SaaS engagement platform on Azure came down to several strategic factors:

- Speed to Value: The SaaS model enabled Desjardins to deploy quickly and see a fast return on their investment; crucial for Desjardins’ timeline.

- Drives Innovation: By leveraging Microsoft Azure, Power-BI, Copilot and GenAI, Personetics could help Desjardins optimize business decisions and create new insights in real-time.

- Agility: Desjardins could easily, and frequently, add new functionality upgrades as they are released.

- Predictable & cost-effective pricing (TCO): Reduced overall effort and enabled quicker upgrades without requiring operational resources.

- Enterprise Security: Personetics’ SOC 1, 2, and 3 certifications provided the necessary security foundation.

- Cost-Effective Maintenance & Operations: The cloud infrastructure eliminated the need for extensive internal hosting, enabling Personetics to quickly and easily access the transaction data, leverage the production and testing environment, and train machine learning models.

Lucy Li, Senior Industry Advisor at Microsoft, further highlighted how their part in this partnership exemplifies modern banking innovation: “Our latest co-pilot technology, combined with Azure’s cloud capabilities, helps banks create sophisticated digital experiences rapidly while maintaining enterprise-grade security and scalability.”

Early Success and Future Vision

Such a fast deployment—a Personetics record and 50% faster than typical on-prem or private cloud deployments—was only possible thanks to a great human and technological partnership between teams Desjardins, Personetics, and Microsoft.

And the fruits of Alvie are already clear for all to see. Desjardins members “already love it,” and initial metrics validate that:

- +30% Engagement Rate

- 15.3% Click-Through Rate

Alvie is Going into Business

Perhaps the greatest testament to the success of Alvie lies in the fact that Desjardins plan to leverage the proven benefits of Personetics SaaS on Microsoft Azure. They will be adding dedicated support for small-medium businesses (SMBs) to manage their finances and cash flow.

The successful launch demonstrates how, by working with the right technology partners, financial institutions can quickly deploy sophisticated AI-powered solutions that deliver immediate value, while building for the future.

Watch Our Joint Discussion

I recently had the pleasure and privilege of joining leaders from Desjardins and Microsoft to reflect on our partnership and the benefits that Alvie has brought to both Desjardins’ members and their overall business within such a short duration.

To get a deeper dive into the Desjardins-Personetics-Microsoft partnership, watch the full webinar and hear directly from the project leaders.

Contact Us today for a complimentary consultation session to learn how Personetics can help you enhance your customers’ digital banking experience.

Want To See How Cognitive Banking and AI Can Transform Customer Engagement?

Request a Demo Now

Related Posts

Engagement Marketing Masterclass: Taking Data-Driven Personalization to the Next Level

From Raw Data to Touchdowns: How Enriched Transaction Data Drives Business Value

Understanding AI’s Impact on Banking

Beyond PFM: The Rise of Impactful Personal Financial Engagement (PFE)

The Rising Tide of Banking Personalization: Insights from FIS CTO Firdaus Bhathena

Humanizing the Banking Experience: Interview with “George” Banking Platform Creator Maurizio Poletto

Elevating Finance: OpenAI's Role in Revolutionizing Banking

Innovating for the Underserved: Interview with Varo Bank Founder and CEO Colin Walsh

Embracing Gen Z's Need for Proactive Digital Banking

Saving Money Becoming a Priority for UK Banking Customers

The Path to Purpose-Driven Leadership: Interview with WaFd CEO Brent Beardall

Dorel Blitz

VP Strategy & Business Development

Dorel Blitz brings over 13 years of experience in global strategy and business development in the financial services industry. Dorel joins Personetics from KPMG, where he headed the Fintech sector at KPMG Israel and a member of the global Fintech practice. In this role, Dorel was instrumental in establishing KPMG’s collaborative relationships with global financial institutions and leading Fintech companies including Personetics. He also acted as a subject matter expert and led advisory projects involving digital transformation strategies with financial services organizations. Prior to joining KPMG, Dorel led the Innovation & Fintech practice at Bank Leumi, and earlier in his career he headed the banking & finance division at global research firm Adkit.