January 20, 2021

New Personetics eBook: How Personalized Engagement Can Boost Business Impact

Our latest eBook, The Ultimate Banking Guide to Data-Driven Personalization that Drives Growth, surveys how Personetics’ comprehensive Engagement Platform helps banks focus their efforts to make sure they not only deliver personalized experiences for their customers but differentiate enough to enhance business impact. Read the highlights below or download the full eBook.

Personalized Engagement is a Necessity and Banks Must Step Up

A 2019 Forrester report found that improved digital customer experience is the key to driving profitable growth. Yet the pandemic has surfaced “pain points of disjointed customer experiences and lack of personalization” by banks, according to Accenture’s Banking Technology Vision 2020 report, exactly at a time when “such capability simply became expected.” If customers are not receiving the service they expect from their bank, they will simply go elsewhere.

With personalized digital experiences becoming a business necessity, banks whose personalization programs are still in their infancy need to up their game. But doing so takes time and investment. Luckily, banks sit on customer financial transaction data (i.e, checking and savings accounts, mortgages, cards data and investments), the starting point of any effective personalization strategy. Harnessing that data to give customers more personalized, automated financial experiences will deliver the ROI on their personalization initiatives.

The Building Blocks of Financial Data-Driven Personalized Engagement

Personetics Engagement Platform analyzes financial transaction data to create engagement that directly translates into business impact—the end goal of any effective personalization strategy. We do that by taking customers through a personalized engagement journey. When a customer opens their banking app, they usually have a particular need or goal. If the bank can anticipate that need and provide relevant insights and advice in response, that builds trust. Alternately, if they log in and sees an irrelevant offer, trust is eroded.

Trust opens the door for banks to offer products and services that automate their customers’ financial lives, leading to better financial outcomes than customers may have achieved on their own. All this matters because customers that trust their bank enough to take financial action on their behalf are more likely to buy products, transfer funds into the bank, and remain loyal in the long term.

Building Block #1: Personetics Engage

Personetics Engage encourages engagement which in turn drives revenue because its insights are proactive, relevant, actionable and contextual. Engage uses AI, machine learning, and predictive analytics to push relevant financial information to customers in a manner that is actually useful to them.

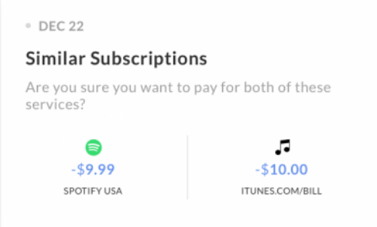

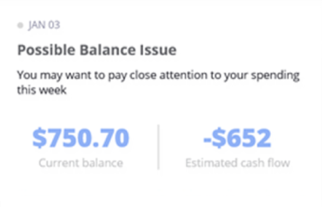

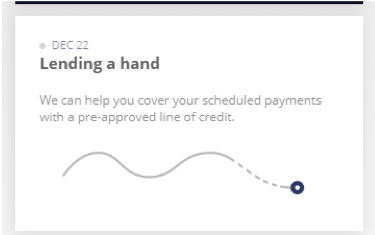

When customers interact with their data to improve their financial position, banks are able to turn them into revenue generating opportunities. Take contextual sales offers. Engage evaluates a customer’s real-time eligibility for a product or service, such as a pre-approved loan or credit card, and their likelihood to buy, and then generates actionable insights that are pushed to customers through their mobile app. Customers only receive the insights when they are most likely to need it, like in the example below.

Marketing offers that were previously delivered out of context, sometimes falling on deaf ears, become significantly more relevant‚ and therefore much more likely to prompt a purchase. A Personetics analysis found that lending penetration offered contextually grew by 11% in just several months.

Building Block #2: The Engagement Builder

Insights, and even a certain baseline of personalized insights, have become table stakes. To really differentiate, banks need to offer data-driven personalized insights that are hyper-customized to the needs of a particular customer segment. But building any technology internally at a bank is a struggle even in good times, involving multiple departments, decision hierarchies, and roles across the bank, from programmers to marketers.

Personetics’ Engagement Builder offers banks a seamless way to build personalized engagement offerings in-house. It is a codeless creation and management console that helps banks craft custom content and engaging insights and deploy them quickly to all channels. Banks can import data from other channels or incorporate Personetics’ 300+ out-of-the-box insights to easily deploy marketing offers, contextual sales, and product launches directly to the most relevant audience.

In the quick transition to remote work early in 2020, Hyundai Card’s marketing team used the Engagement Builder to deliver immediate insights based on customer needs, without involving its IT department. They were able to offer, for example, more online benefits while stay-at-home policies were in effect, and to split large payments or defer payments to reduce financial stress and increase LOC for eligible customers—all leading to a 17.7% click-through rate that covered more than 95% of Monthly Active Users.

Building Block #3: Personetics Act

Personetics’ Act, Automated Financial Wellness Programs, engage customers in habit-forming financial wellness behavior over an extended time frame. Unlike manual savings programs which see low adoption rates because they put the onus on the customer to take action, automated programs work on the customer’s behalf, finding pockets of funds that customers would not have thought to put into savings, transferring them to build up savings over time, and self-adjusting as customers’ circumstances change. Act builds on the trust established through personalized data-driven insights. It leverages existing and acquired knowledge of the customer to not only encourage ongoing smart financial behavior, but to undertake that behavior for the customer.

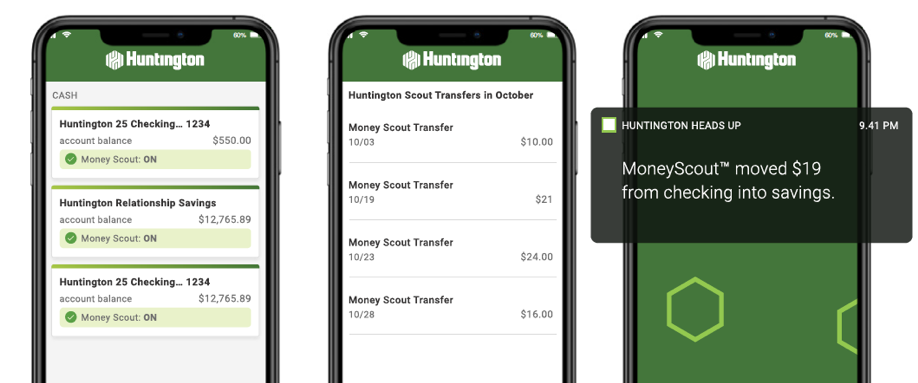

Huntington Bank’s Money Scout automated savings tool “Money Scout” self-adjusts to determine the optimal amount to transfer and ensures the account has sufficient funds to cover all transactions, all friction-free and seamless to the customer. It continuously monitors the progress of the savings and sends push notifications to update customer progress, alerts that promote the amount of funds already saved, and supportive nudges to keep people on track. To date, Money Scout has helped customers save $1.7M, an average of $115 per month.

[Deep-Dive into Personetics Act: Read the eBook]

Personalization is Good for Business

Personetics’ algorithms account for changing financial realities, suggest action accordingly, and automate those processes for the customer. Together, these capabilities contribute to an unprecedented level of sophistication, driving trust and engagement that translates to tangibly improved business outcomes:

- 5-8% improved retention

- 7-pt NPS growth, average 4.4/5-star rating

- 31% of funds deposited from insights and advice originate externally

- 17% CTR on tailored products and services

To get started on building a data-driven personalized engagement strategy, download the full eBook, The Ultimate Banking Guide to Data-Driven Personalization that Drives Growth.

Want to explore how your bank can harness the power of AI to engage and serve customers? Request a demo now

Latest Posts

The AI Implementation Reality Check

Why Asia Pacific Pacific Banks Must Lean into Cognitive Banking: A Conversation with Dr. Dennis Khoo

Explore our Spring Release Highlights – From Integrated Marketing Offers, to Custom Trackers, and AI Innovation