Executive Summary

Executive Summary

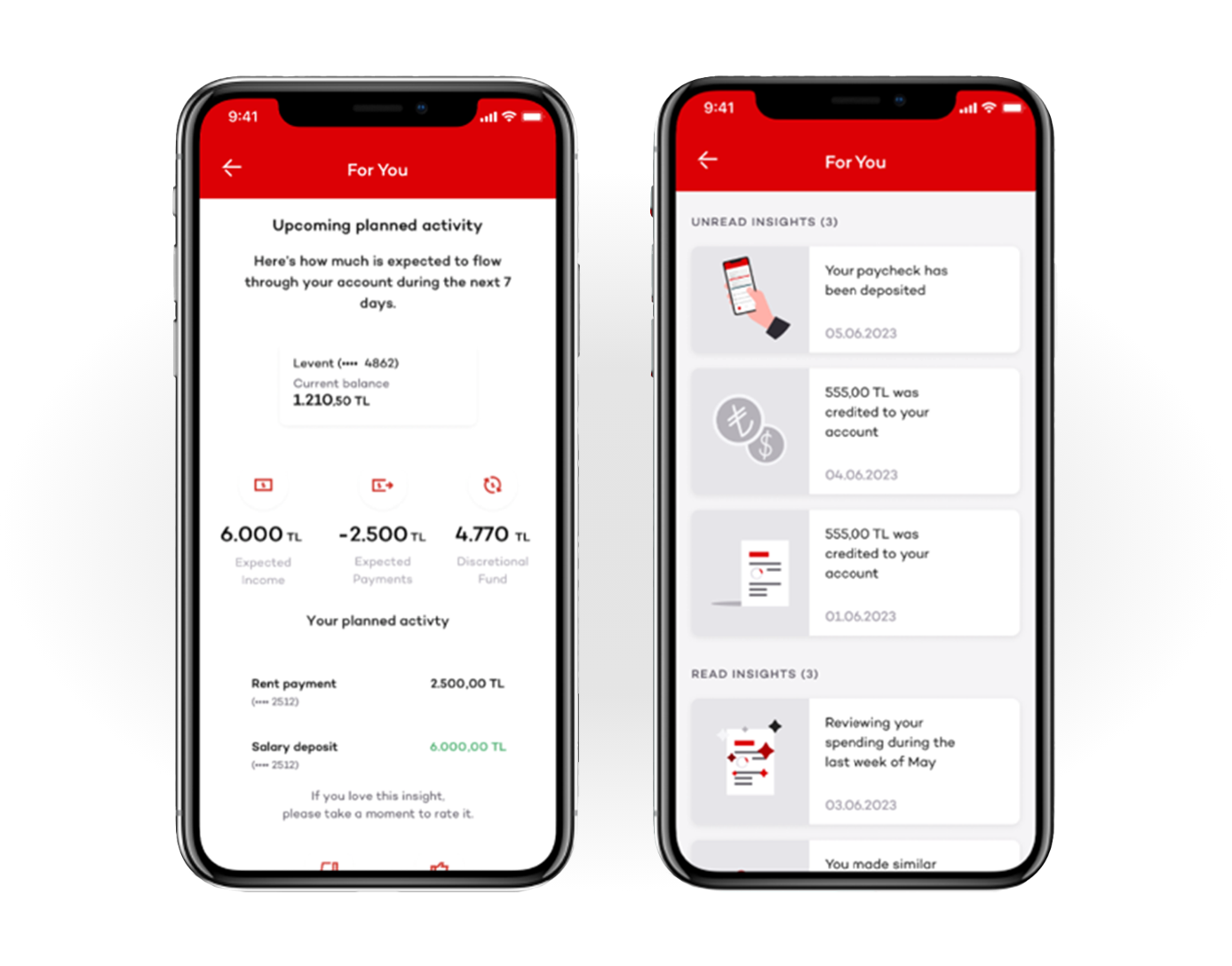

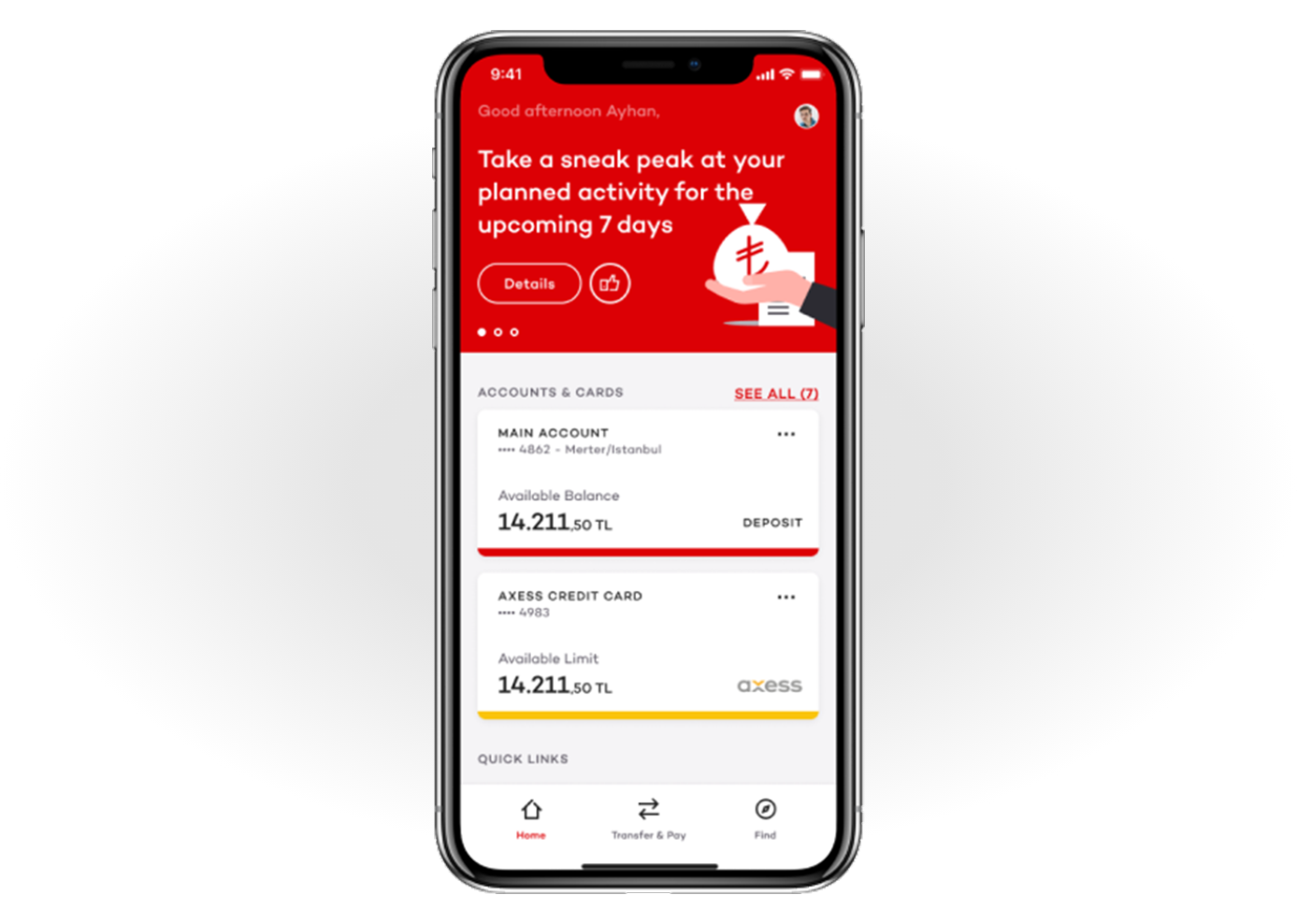

Akbank is one of the leading Turkish banks known for its innovative use of technology and customer-oriented service model. The bank’s digital innovation team decided to redesign its mobile application to act as a trusted financial advisor to increase customer engagement and revenue growth. Partnering with Personetics, Akbank was able to offer its customers hyper-personalized insights into their spending patterns and present saving opportunities utilizing an analysis of the customer’s financial data. This AI-driven personalized solution not only increased the customer engagement rate and boosted satisfaction, but also reinforced Akbank’s position as the most technology-savvy bank in Turkey.