The Solution

Hyundai Card knew they needed a partner to help them achieve their lengthy list of ambitious goals. They selected Personetics for their wide range of powerful, proven money management capabilities.

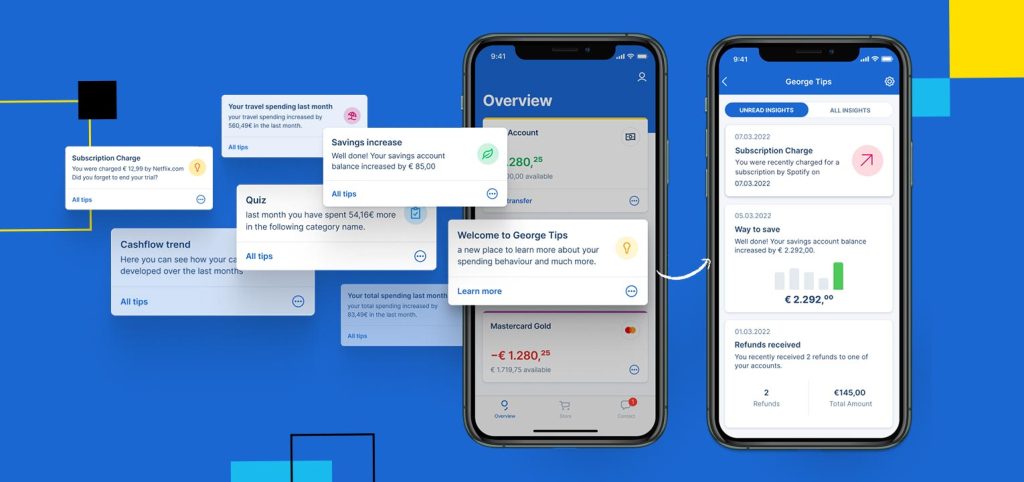

After a smooth implementation, Hyundai Card began using the Personetics’ Engage solution to leverage their customers’ financial transaction data and send out timely, contextual, personalized insights and advice, such as spending forecast based on recurrent activities, notifications on duplicate charges, subscription cancellations, and category anomalies. These insights gave customers a better understanding of their spending patterns and alerted them to the benefits – both daily and annual – available to them as card owners.

Hyundai Card saw an almost immediate improvement in both customer engagement and the number of digital users. They then built on that great start by taking a critical next step with Personetics’ Engagement Builder, Personetics’ codeless creation & management console. Hyundai Card took what they learned from their customers’ interactions with their digital platform and used the Engagement Builder solution to customize their insights and create new ones to better target their customers’ needs.

Since the start of their partnership with Personetics, Hyundai Card has used Engagement Builder to create over 100 custom insights. They can build new, complex insights in just two to three weeks and generate simple insights in just one week.