Executive Summary

Executive Summary

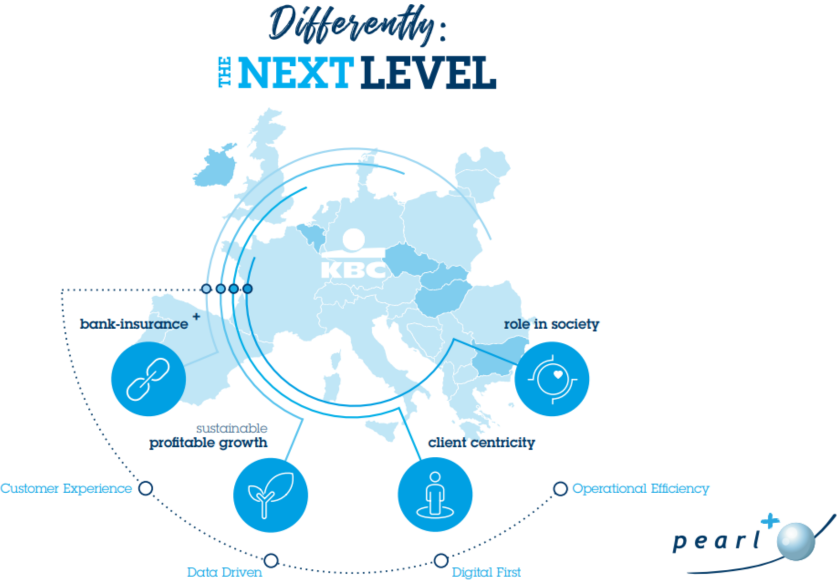

KBC is a multi-channel bank insurance group with a geographic focus on Europe, catering mainly to retail clients, SMEs, and local midcaps. The group occupies significant, often leading positions in its core markets of Belgium, Czech Republic, Bulgaria, Hungary, Slovakia, and Ireland. The KBC group has also established a presence in several other countries and regions around the world.

KBC aims to become the reference for bank insurance in its core markets, which would place it among Europe’s best-performing financial institutions. Their company mission is to enable and protect the dreams of their stakeholders, to “inspire, boost, and stimulate” those who count on them day after day. To realize this vision, KBC sought to increase customer engagement by upgrading its mobile application to meet evolving customer needs.

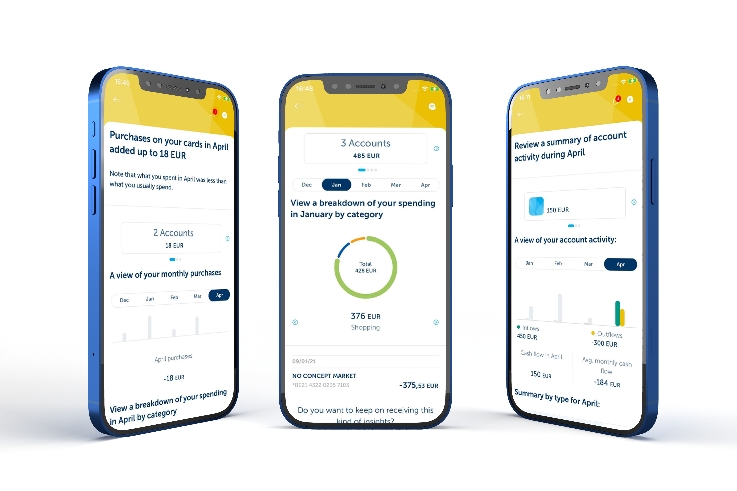

The bank partnered with Personetics to implement a multi-lingual rollout of Personetics’ Engage business solution on KBC’s mobile channel. Featuring AI capabilities, the solution helps customers better manage their financial lives by offering hyper-personalized, datadriven insights and smart budgeting advice.

As a result of implementing Engage, KBC saw a clear rise in engagement, including high opt-in and session use above industry benchmarks with a +90% satisfaction rating.