- Homepage

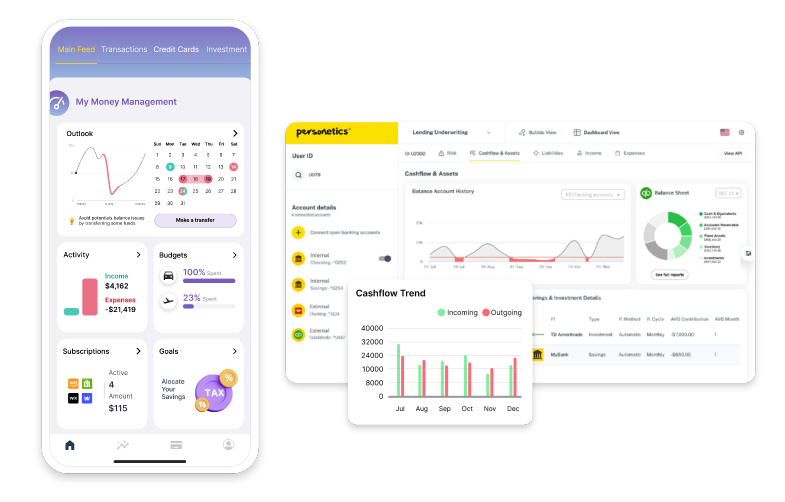

- Products

- About us

- Solutions

- Resources

- Resources Hub

- Type

- Blog

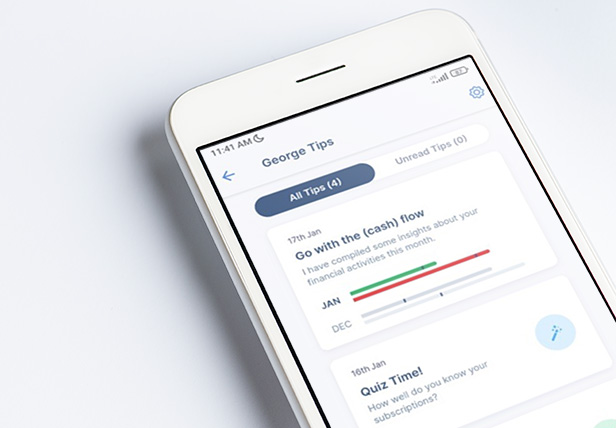

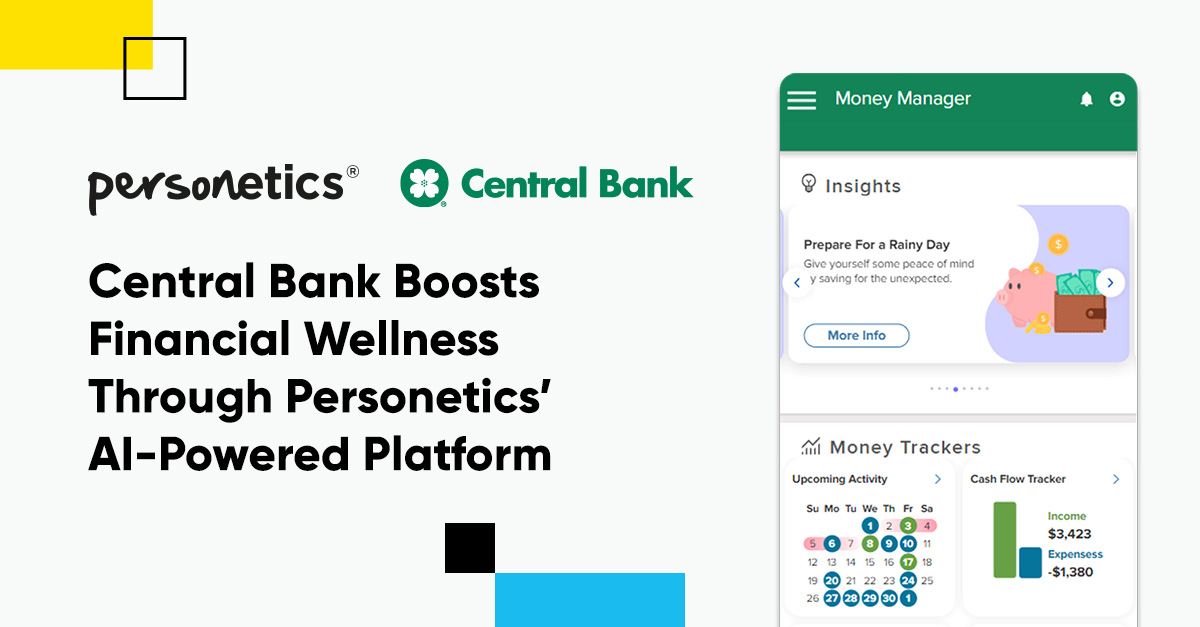

- Customer Stories

- eBooks

- Events

- Webinars

- Reports

- Podcasts

- Videos

- Press Releases

- Business needs

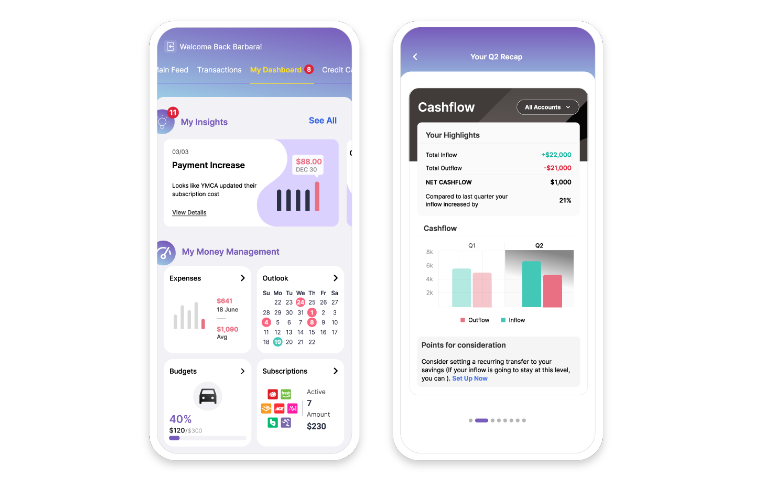

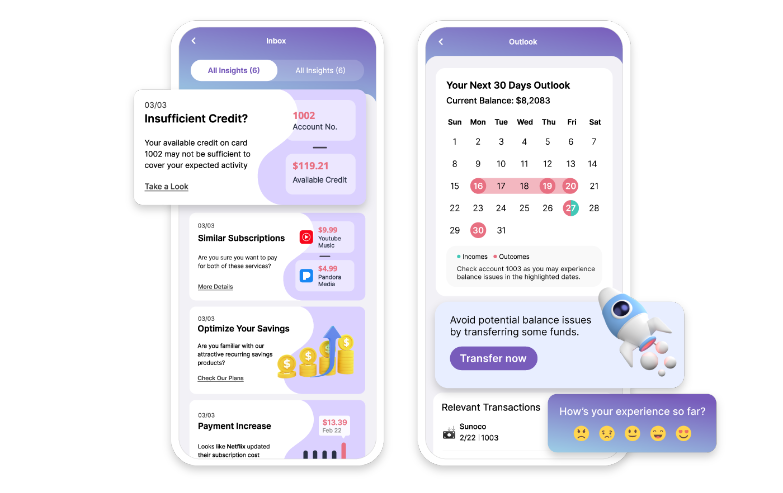

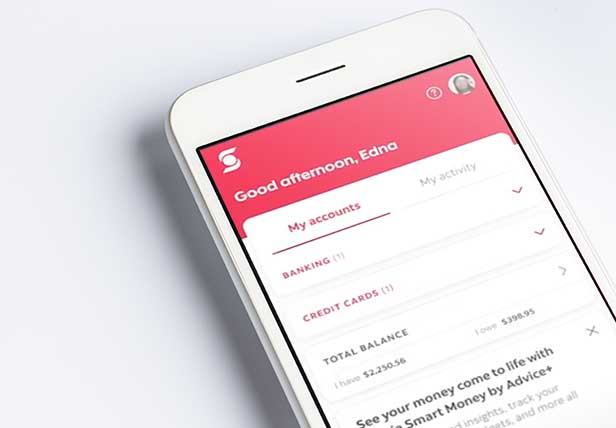

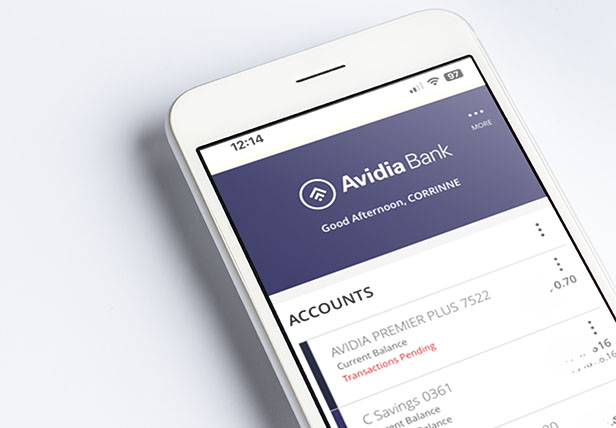

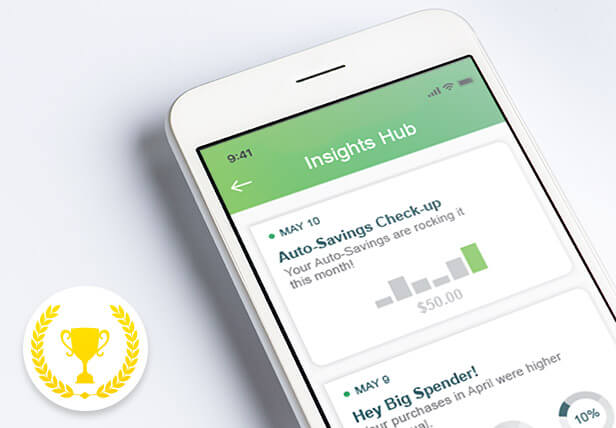

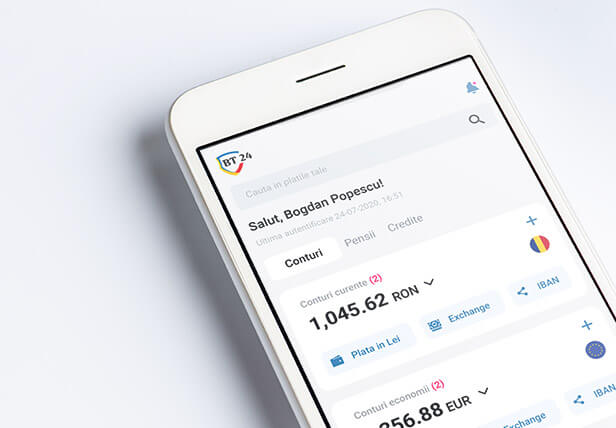

- AI-Powered Banking

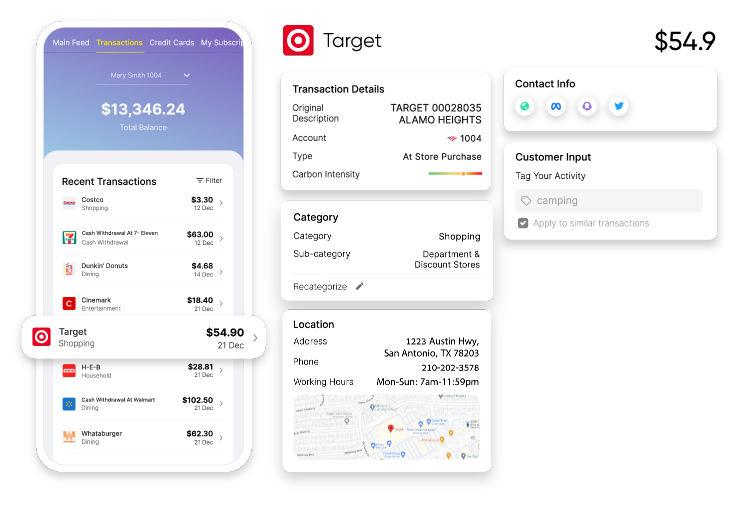

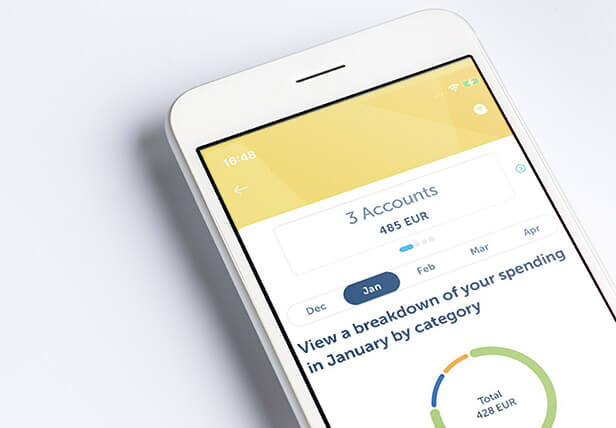

- Categorize and Enrich Transaction Data

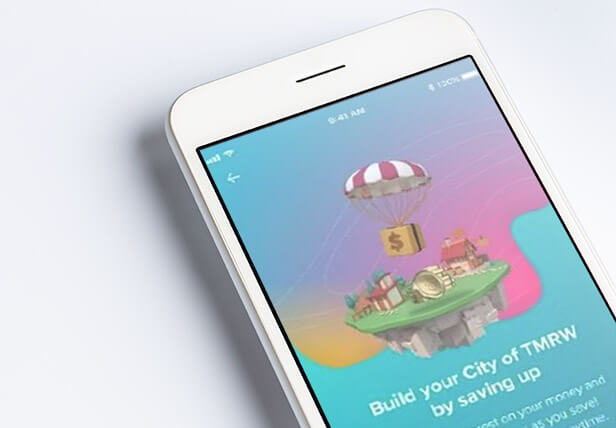

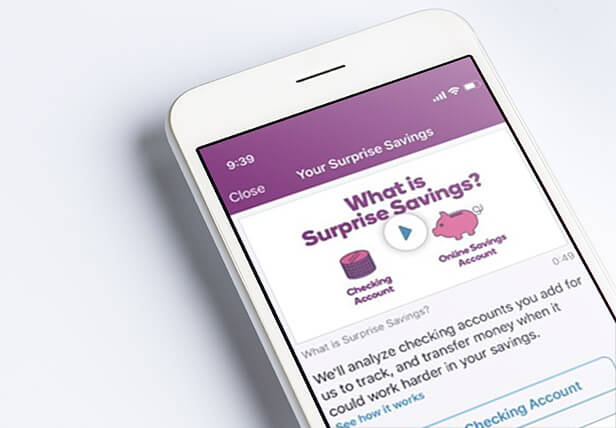

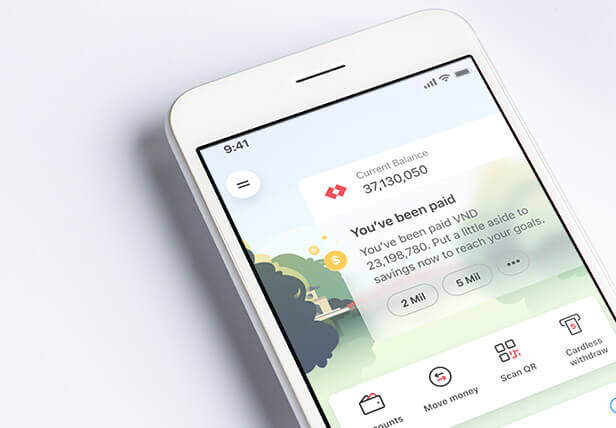

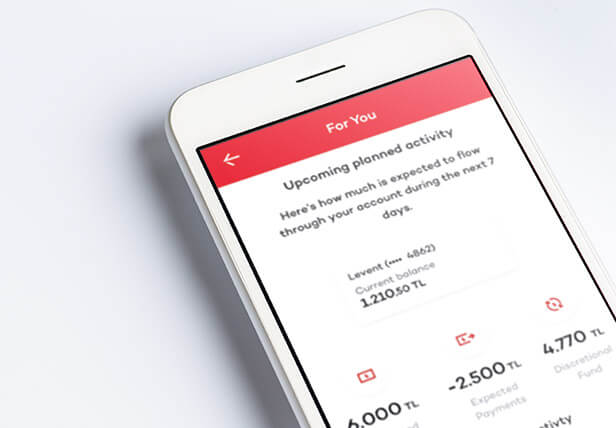

- Deliver Value beyond Traditional PFM

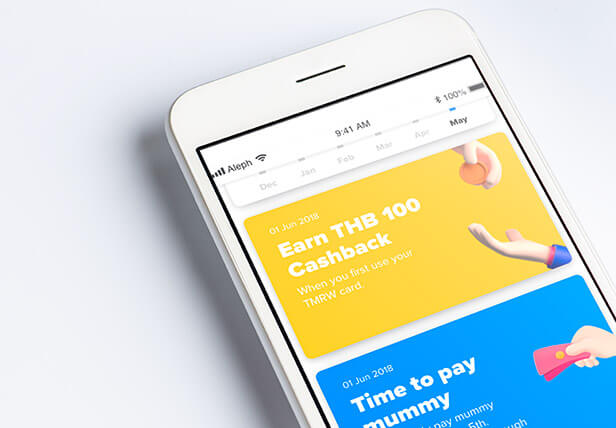

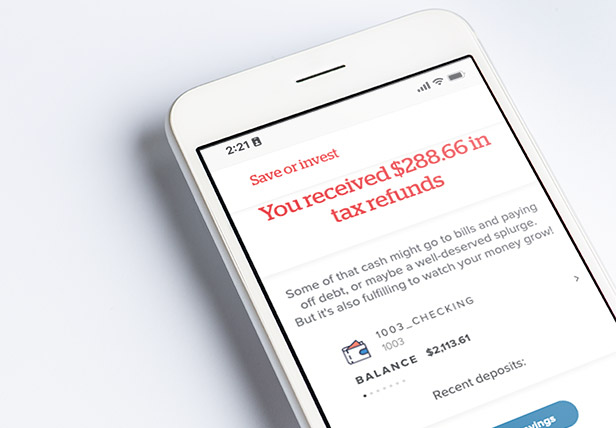

- Increase Customer Engagement and Sales

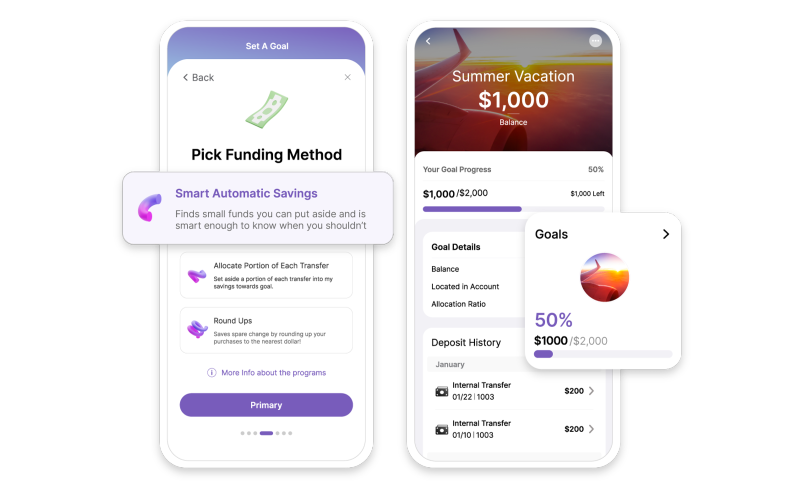

- Improve Customers financial well-being

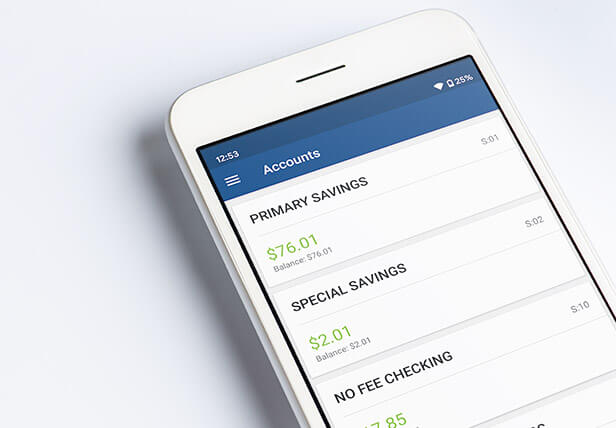

- Win, Grow and Retain Deposits

- SMB/SME Banking

- Reduce Customers Carbon Emission

- News