- Homepage

- Products

- About us

- Solutions

- Resources

- Resources Hub

- Type

- Blog

- Customer Stories

- eBooks

- Events

- Webinars

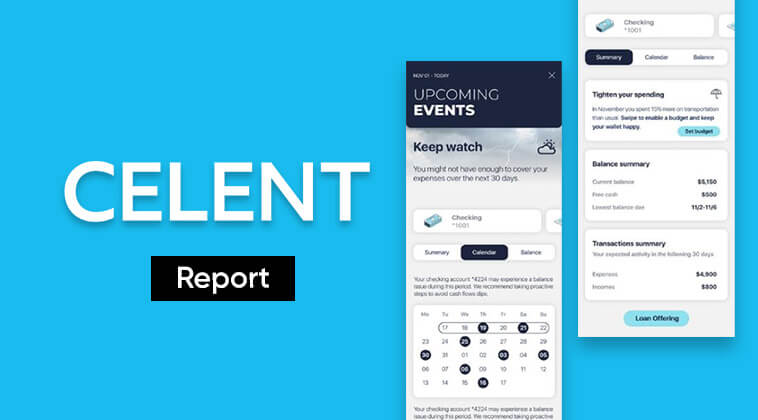

- Reports

- Podcasts

- Videos

- Press Releases

- Business needs

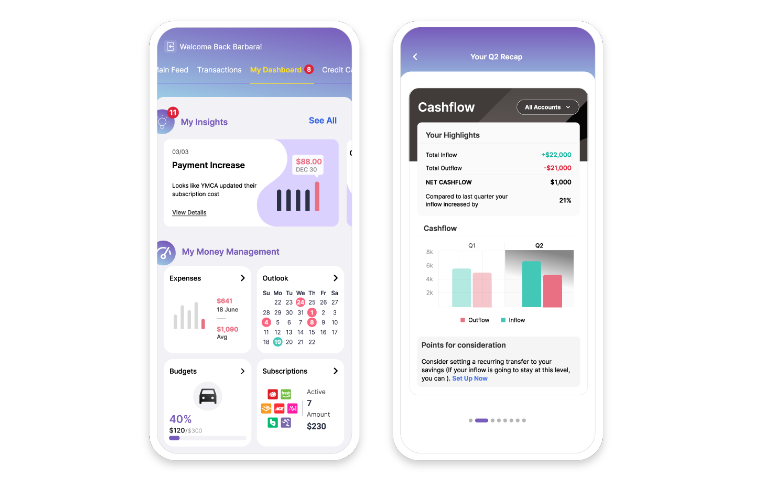

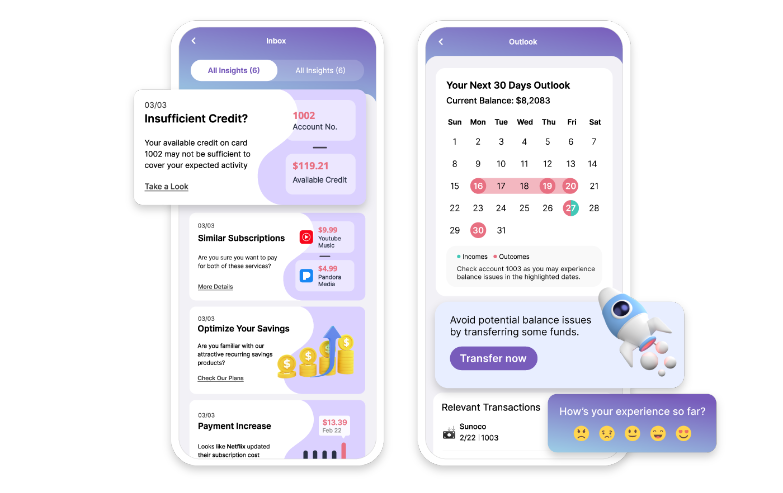

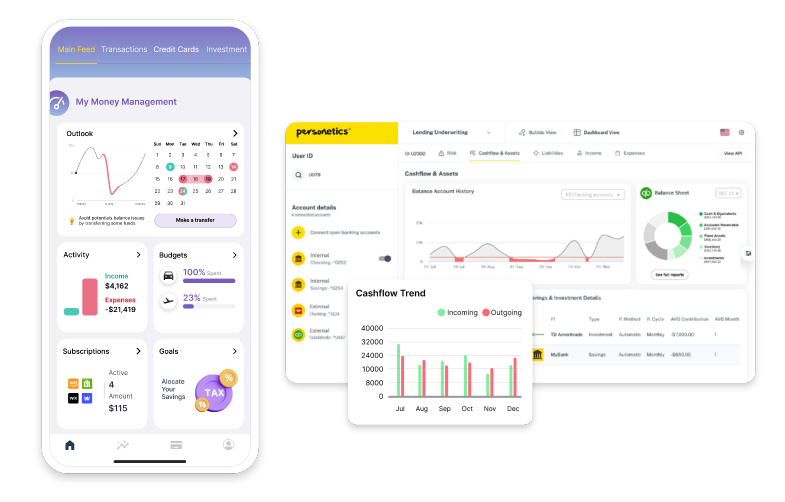

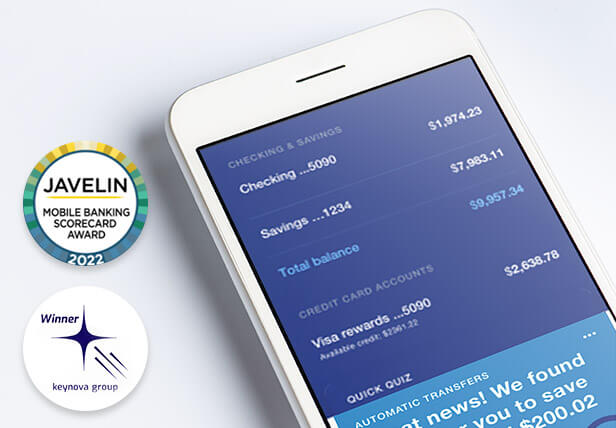

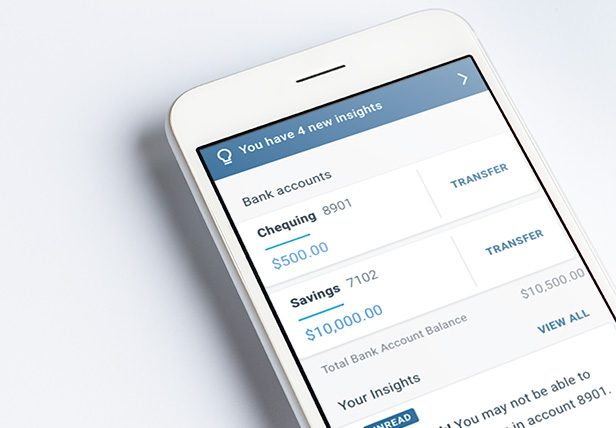

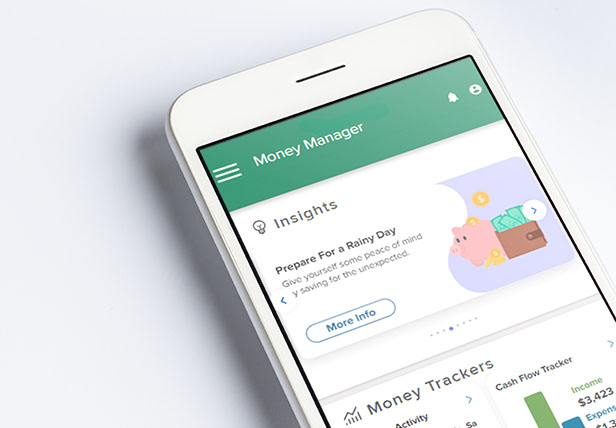

- AI-Powered Banking

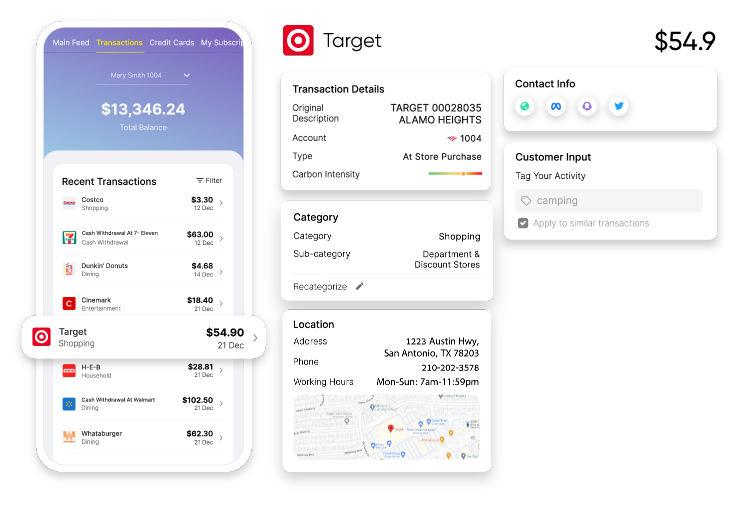

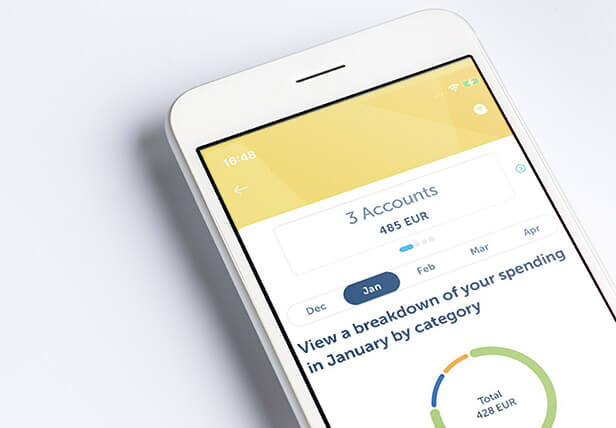

- Categorize and Enrich Transaction Data

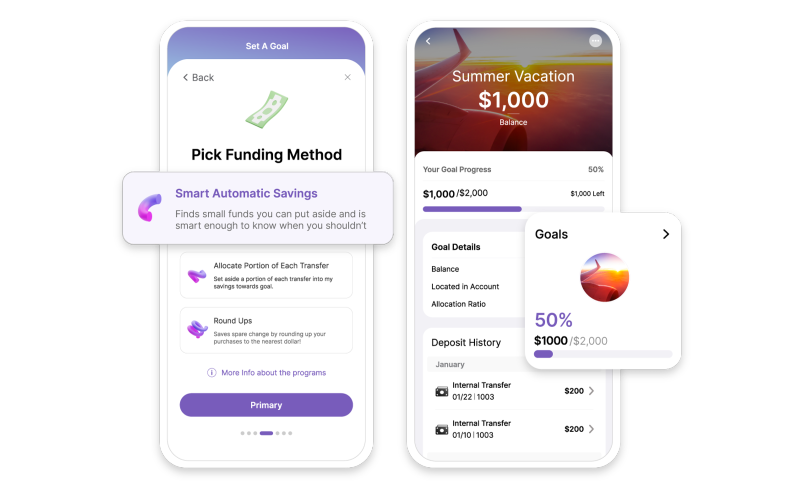

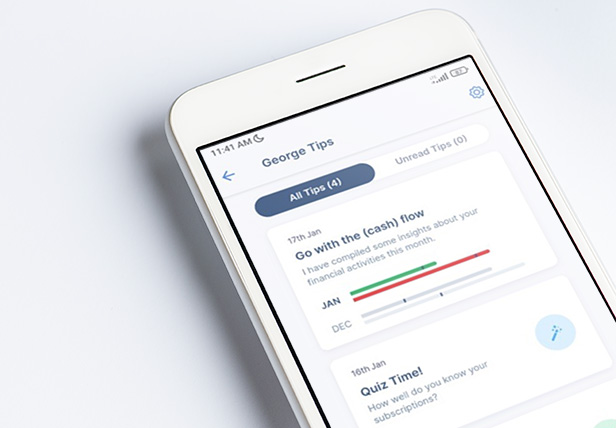

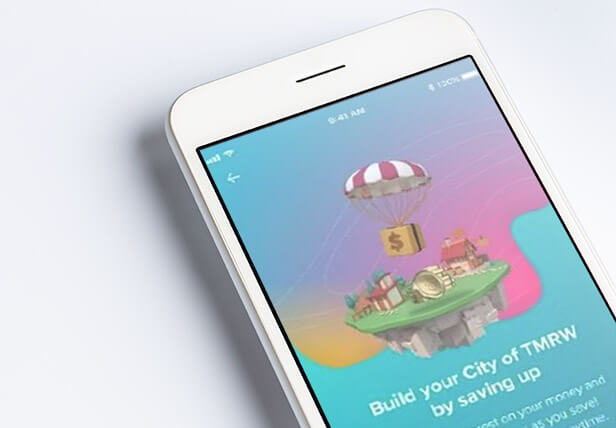

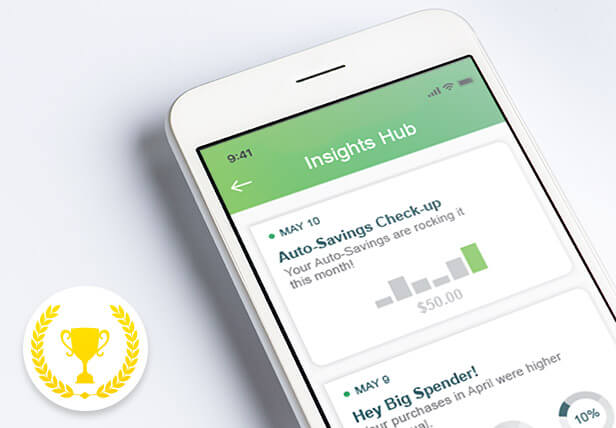

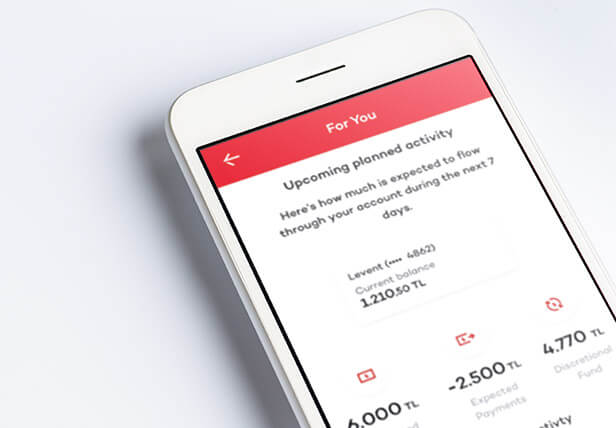

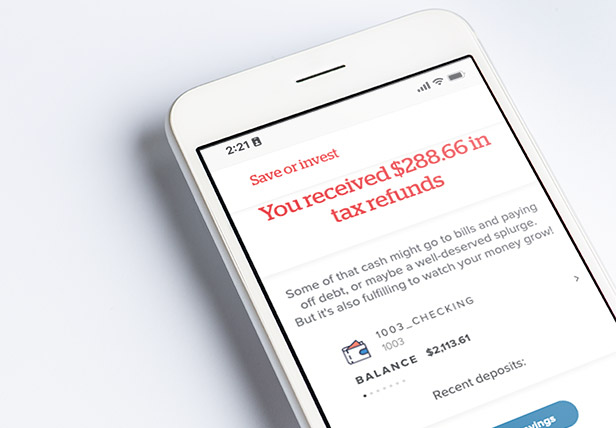

- Deliver Value beyond Traditional PFM

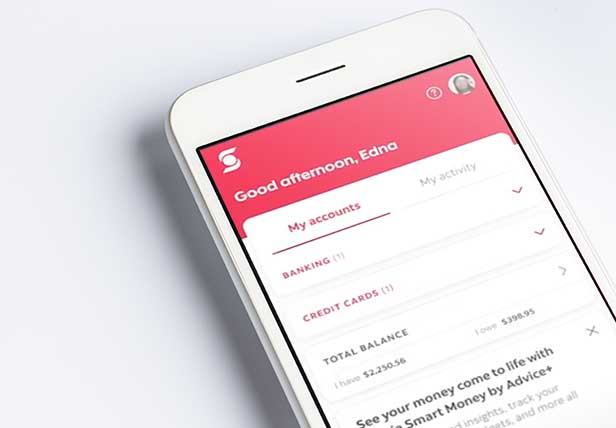

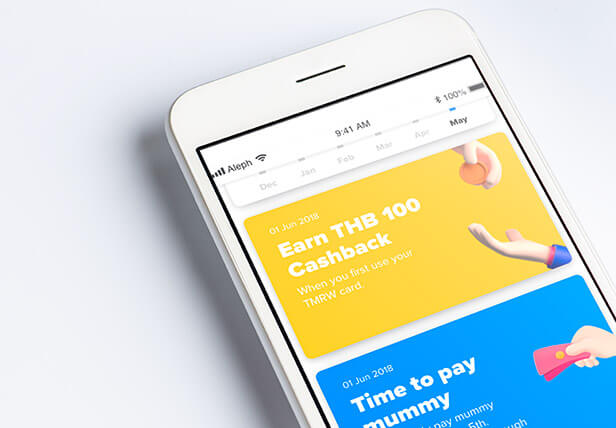

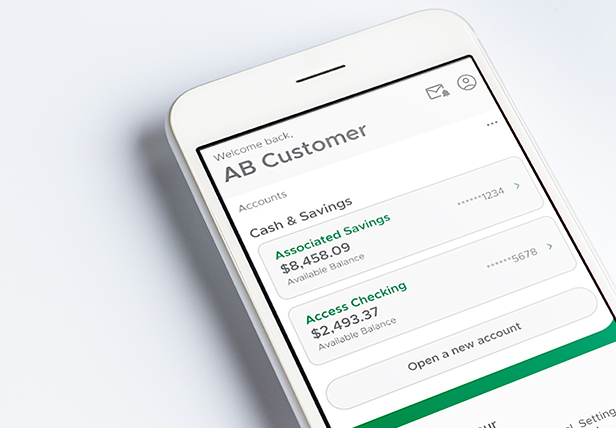

- Increase Customer Engagement and Sales

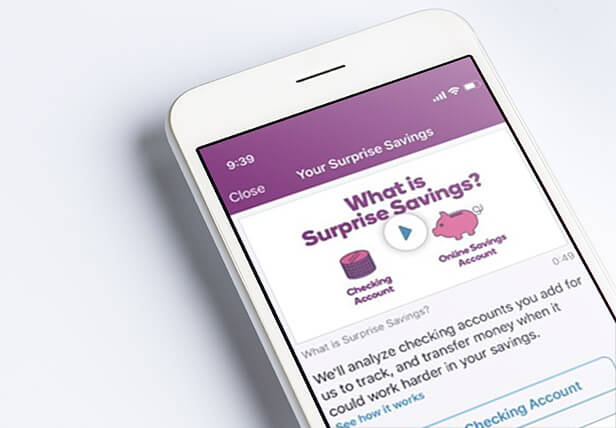

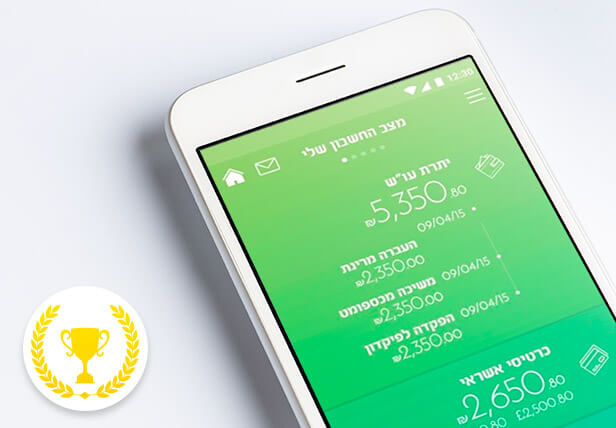

- Improve Customers financial well-being

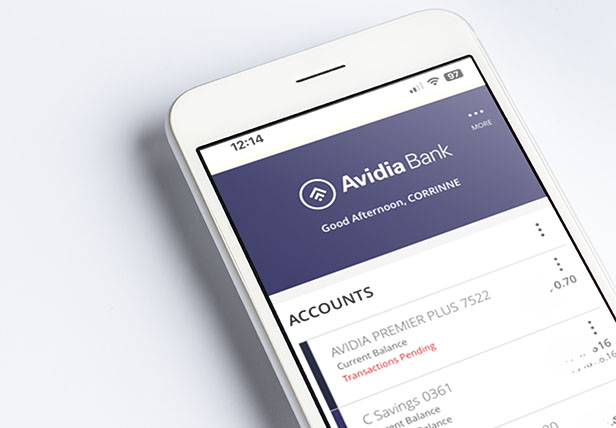

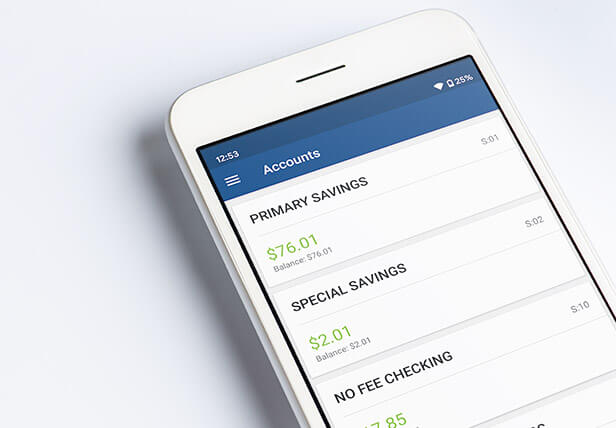

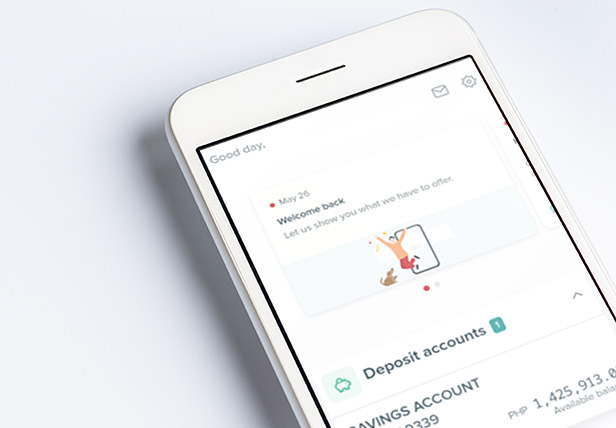

- Win, Grow and Retain Deposits

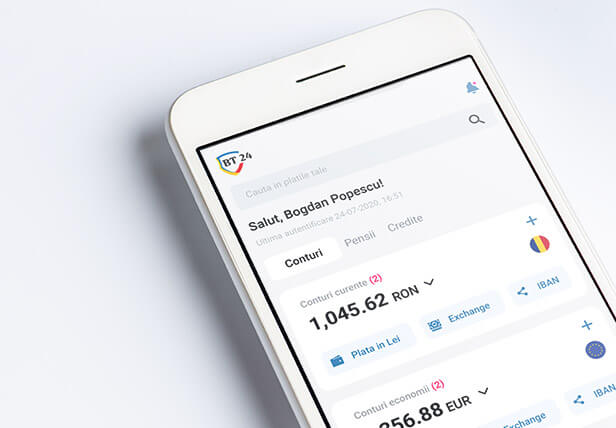

- SMB/SME Banking

- Reduce Customers Carbon Emission

- News